[ad_1]

Tesla CEO Elon Musk reiterated his support for Bitcoin at a meeting on Wednesday, saying that he owns the token along with Dogecoin and Ethereum.

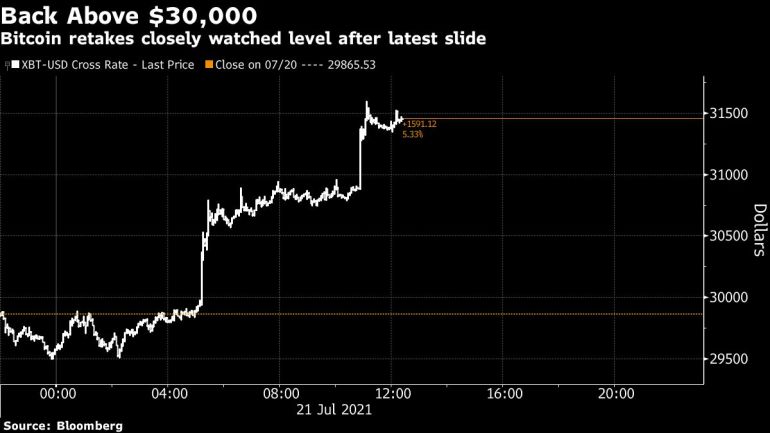

Bitcoin’s gains exceeded $32,000 and continued to rebound after wiping out most of this year’s gains. Elon Musk, Jack Dorsey and Cathy Wood gave their latest speeches in a panel discussion on the future of Bitcoin.

As of 2:27 pm in New York on Wednesday, the largest digital currency rose more than 8% to approximately $32,270. Other cryptocurrencies also rose, including Ethereum and Dogecoin, and the Bloomberg Galaxy Crypto Index is also in the green state.

Tesla CEO Musk reiterated his support for Bitcoin, saying that he owns Bitcoin as well as Dogecoin and Ethereum. He also said that space exploration technology companies also own Bitcoin, just like Musk’s electric car company.

The token rebounded after falling below $30,000 earlier this week, which is the first foray since June.

Naeem Aslam, chief market analyst at Ava Trade Ltd, said: “The market is worried that if Bitcoin falls below the $30,000 mark, the price will drop significantly. In fact, this is not what we are seeing.” Bitcoin prices have been stable and we Did not see any panic selling. “

Since mid-May, Bitcoin and other cryptocurrencies have plummeted, and their market value has evaporated by approximately US$1.3 trillion. Bitcoin faces a series of obstacles, including increased regulatory scrutiny in China, Europe and the United States, and concerns about the energy needed to support its computers. Investors have also generally become more cautious about speculative assets.

Aslam of Ava Trade stated that Bitcoin may still test the $25,000 support level in the coming weeks. Saxo Bank Chief Investment Officer Steen Jakobsen said that a breakthrough of US$32,000 would herald a stronger recovery.

Jacobson wrote in a report: “After Bitcoin fell below the critical area of ??$30,000 yesterday, Bitcoin and Ethereum did succeed in pulling up, but it does need to sustainably rise above $32,000 to get out of the predicament. .”

After falling from a record of nearly $65,000 in April, Bitcoin’s gains this year have shrunk to around 8%. In contrast, the S&P 500 Index rose 15% in 2021.

Proponents believe that virtual currencies provide an inflation hedge and will win wider institutional acceptance. Although Bitcoin’s most ardent fans continue to predict long-term returns will be high, this statement has always caused controversy and is now being more questioned.

Edward Moya, senior market analyst at Oanda Americas, wrote in a report: “Regulatory and environmental issues may make Bitcoin heavy, but improvements in both areas should happen before the end of this year.” He added, If they avoid falling to $20,000, institutional investors are “prepared to make long-term big bets.”

[ad_2]

Source link