[ad_1]

This article is a live version of our trade secret newsletter.registered Here Send the newsletter directly to your inbox every Monday to Thursday

Hello, from Brussels. So, obviously football is over and we can’t say that we care (whispering sobbing).

Usually by this time, the city is ending for the summer vacation, but this week there will be a major announcement-the climate measures package is rather strangely called “Suitable for 55 middle-aged to lose weight (” I must say, you are looking for… ..”). We will check them in due course, especially the carbon boundary measures.

Today, in order to breathe a sigh of relief, we will look at the predictability of UK trade policy, taking into account brand new institutions and capricious government (the clue lies in the framework of the problem).

Concession waters See why China’s relaxation of foreign investment rules will have a huge impact on the global market.

We hope to hear from you.Send any ideas to [email protected] Or email me [email protected]

UK trade policy: chips, farms and steel

If Brexit has given us one thing, besides the surprisingly stimulating narrative projected onto football matches, it is the unusual experiment of observing developed economies trying to rapidly develop institutions and trade policy ideas in public (well, It’s a bit like being public: the UK’s trade policy can A little more transparency, honestly).

There have been two recent and one older rubber road accidents, both involving the screaming of tires when the State vehicle changed direction at high speed.First, the Minister of Trade Liz Truss actually New legislation was enacted To overthrow Britain’s shiny new Trade Remedy Bureau So she can stay in place Emergency safeguard duty Britain inherited steel imports from EU member states. Second, the government obviously changed its mind. Referrals For national security reasons, China is bidding for semiconductor manufacturer Newport fab for investment review. The institution set up to take over this task, Invest in safety stocks, Too new, it hasn’t actually been launched yet.

Earlier this year, the Boris Johnson government broke its promise and apparently agreed to the Australian negotiator’s request to open the British agricultural market to its super-competitive agricultural exporters. This surprised many people—especially British farmers. And the way is not pleasant. .

When the UK began to implement post-Brexit trade policy, the Conservative Party decided to protect steel manufacturers, but it hurts farmers, you may have a great chance of winning (at least from us).For centuries, the Conservative Party has been intermittently becoming agricultural protectionists: one of their The greatest prime minister Was knocked down.In the past, when the steel industry collapsed and fell apart, it seemed that there was not much feeling for the steel workers. Half of the workers Between 1979 and 1981.Today’s trade secret authors remember the lasting Shock wave A steel plant near his hometown closed and lost more than 5,000 jobs in one day. It must be the kind of upgrade we have been reading.

The steel decision is even more compelling because it involves a system designed to distance politics from trade remedies. The Trade Remedy Bureau was set up to provide advice to ministers in a way that is hard to ignore, because it means accepting or rejecting a series of proposals completely, rather than picking and choosing. The technocratic process is a bit like the American system. In the United States, the International Trade Commission, a non-partisan federal agency, makes judgments based on established laws to determine whether a department is harmed by dumped or subsidized imports. A senior DC attorney once said that the US trade remedy law may be ridiculous because it is too easy to prove dumping or subsidies and apply tariffs, but at least this is predictable. By changing the minister’s acceptance of the all-or-nothing recommendations of the Trade Remedy Agency, it is ironic that Truss has adopted a more EU-style approach, that is, the trade defense authorities have more leeway to make changes. Extensive economic and political judgments. Put it in the bloated “attempt to disagree after Brexit failed” document.

With the semiconductor decision, the ministers decided to submit the matter for national security review, which may be more surprising than they thought it would not.The Johnson administration made a Big turn Last year broke the David Cameron/George Osborne era strategy of turning Britain into one of China’s most reliable trading and investment partners.Politically it is subject to China Research Group, A group of backbenchers from the Conservative Party who are skeptical of China. They do not have a well-organized opponent on the pro-China side. Given the events in Hong Kong and Xinjiang, few elected politicians are now ready to stand up for Beijing.

In other words, the UK can create any fine-calibrated trade and investment policy tools it wants. But in the final analysis, especially in such a newly created system, it will play a greater role than a political whim. It is the word on a whim: what we have seen so far reflects the highly unpredictable tone of the Johnson administration. As Alex White of consulting firm Flint Global said nonchalantly, “There is currently a high level of political beta on these issues.”

If you are the kind of person who monitors the unpredictability of trade policies to make fun of (we are), then it will be fun to watch. But as a farmer, business owner or employee, his job relies on these erratic processes, which is not interesting.

Concession waters

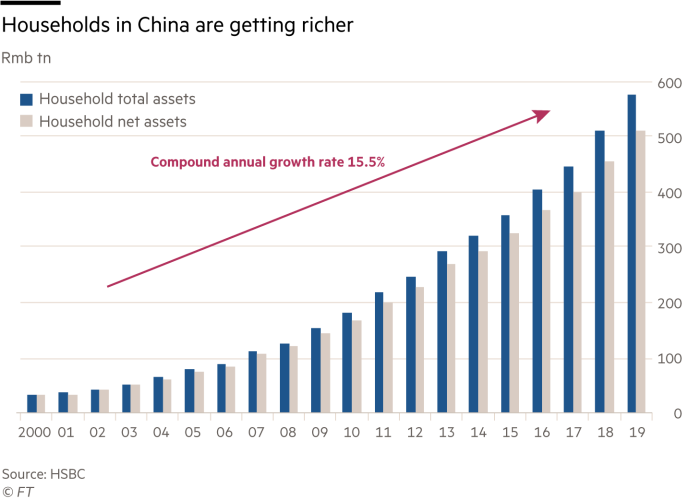

The Chinese government is considering whether to relax restrictions on foreign investment by citizens, allowing them to invest up to US$50,000 in foreign countries.

At this Excellent reading, Thomas Hale and Tabby Kinder explained some of the reasons this will have a significant impact on global capital markets. Chief among them is the country’s super-high savings rate and the rapid growth of China’s wealth. The following is the key chart. Claire Jones

Trade ties

Pepijn Bergsen of Chatham House has one Research papers published why EU’s China Strategy Is not sustainable. It is worth reading.

This Chip shortageYes influences Car rental prices.Taiwan Semiconductor Giant TSMC , Meanwhile, there is gather together with Foxconn To ensure that the vaccineFor the territory.

After the excellent trade negotiation podcast, there is more about using Blockchain powers trade . The seven Asia-Pacific economies are Push forward (Nikkei, $) Establish a cross-border trade network that will connect distribution routes and transaction records and provide alternatives during supply chain disruptions. DiageoYes aim (Nikkei Index, USD) Chinese Scottish drinkers , Planning to expand its Japanese Subsidiaries stagnated.

Piracy Yes right now According to DPA News Agency, it is at a 27-year low. Claire Jones

[ad_2]

Source link