[ad_1]

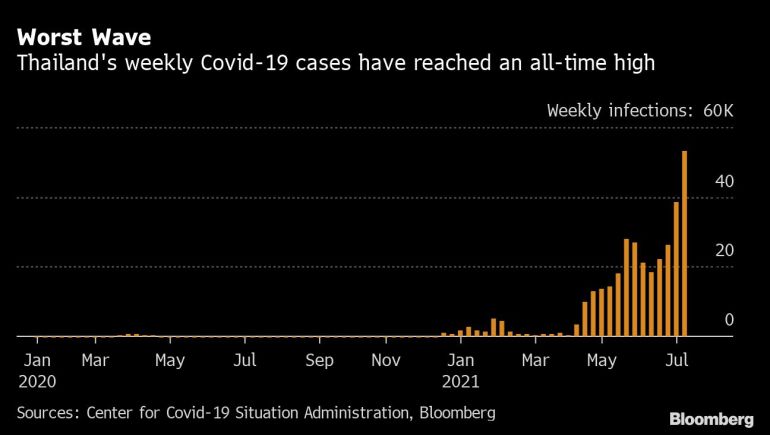

Thailand may adopt measures similar to the lockdown to contain the deadliest Covid epidemic that hit the country, thereby exacerbating its high unemployment rate and household debt in the past decade.

The Greater Bangkok area, which accounts for about 50% of Thailand’s GDP, will close shopping malls, spas, massage and beauty clinics for at least two weeks from Monday. Most government employees’ mandatory work-from-home rules, overnight curfews and domestic travel restrictions will hurt retailers, airlines and restaurant operators who have been affected by some form of Covid restrictions for more than a year.

Thailand is tightening restrictions to stop the spread of the more contagious Covid virus, which has also contributed to a surge in cases from Indonesia to Vietnam and undermined their plans to open the border. The latest measures may further delay the recovery of Thailand’s economy from its worst recession in more than two decades and give Prime Minister Prayuth Chan-Ocha’s goal of welcoming vaccinated tourists back as early as mid-October. Derailed.

Maria Lapiz, managing director of Maybank Kim Eng Securities Thailand, said: “Even if the lockdown period is the same, the economic impact of each lockdown will be greater and greater.” “This is because after so many months of income shrinking and stubbornness. After the high cost of living, many companies are nearing completion.”

Lapiz believes that Thai households have been hit hard and corporate earnings ratings have been downgraded, while Singapore’s DBS Bank economist Radhika Rao said that the growth forecast for Southeast Asia’s second-largest economy “is rising downside risks.”

The following are the implications of the latest Covid restrictions for the Thai economy:

GDP growth:

Even before the announcement of the latest measures, the Bank of Thailand considered the 1.8% economic growth forecast for this year to have “significant downside risks”, saying that the continued outbreak would squeeze corporate liquidity and damage employment in the service industry. It predicts that if herd immunity is postponed until the end of next year, the economy will only return to pre-Covid levels in early 2023.

On Monday, the Bank of Thailand stated that it may lower its 2021 GDP forecast to take into account the worsening of the Covid epidemic, and will closely monitor the situation to determine whether additional policy measures are needed.

DBS Bank’s Rao said: “Although the vaccine supply is expected to provide breathing room for the economy this year, the economic impact may increase before vaccine promotion reaches critical mass.” “The rebound is expected to depend on public spending and exports, while consumption. The weakness casts a shadow on private sector investment trends.”

Unemployment, debt:

The unemployment rate may rise from 1.96% at the end of the first quarter, which is the highest level since 2009, as more people may be unemployed as the epidemic continues and businesses are restricted. The blow to the urban service industry may encourage more people to engage in agriculture, a trend that emerged during the national blockade last year.

The Bank of Thailand last month predicted a “W-shaped” recovery in the labor market, slower than the past rebound, because its so-called fragile service industry has left deep scars.

Thai household debt has soared to an 18-year high of 90.5% of GDP. In view of the tightening of restrictions resulting in unemployment and reduced income, Thai household debt may rise further. This will severely weaken consumer spending as a key engine of economic growth.

Vaccination:

Thailand has distributed about 12 million doses of vaccine, enough to cover about 9% of its population, ranking behind more than 120 other regions in terms of vaccination rates. Kampon Adireksombat, deputy managing director of SCB Securities, stated that the government needs to increase vaccination efforts and consider using most of the planned 500 billion baht loan program to “ensure access to better quality vaccines, rather than compensate those affected. Groups and stimulate the economy”. Investment office.

“If we implement a lockdown without increasing vaccination, new cases may temporarily decline before they rise again,” Kampon said. “We will be in an ugly cycle of blockade and compensation. This will damage the economic prospects for next year.”

Currency, stocks:

Investors have been the first to be affected by the worsening pandemic in Thailand. The country’s currency and stocks have fallen for four consecutive weeks. Although the strengthening of the U.S. dollar caused the Thai baht to fall to a nearly 15-month low, the stock market has suffered a net divestment of 2.6 billion U.S. dollars so far this year.

The earnings of consumer product companies, retailers, airlines, hotels and shopping mall operators may be affected by the weak economy and continued restrictions, while the Thai baht may be more affected by the U.S. dollar.

“Foreign investors may avoid high-risk emerging markets, including Thailand,” said Standard Chartered’s Kampo. “The Thai baht will remain weak and the central bank will only step in to curb excessive volatility. But this should be good for exports, which should support the economy.”

[ad_2]

Source link