[ad_1]

This article is a live version of our Unhedged newsletter.registered Here Send the newsletter directly to your inbox every business day

I think many of my British readers will have a hangover this morning as the England team has reached the Euro 2020 final. After considering the opaque bond market all day on Wednesday, I also need a drink. If you know the secret that the market is hiding from me, please send an email to: [email protected]

There are many explanations for the decline in yield, but none of them are good

I have been away for about a week. The important news after I leave is:

And this:

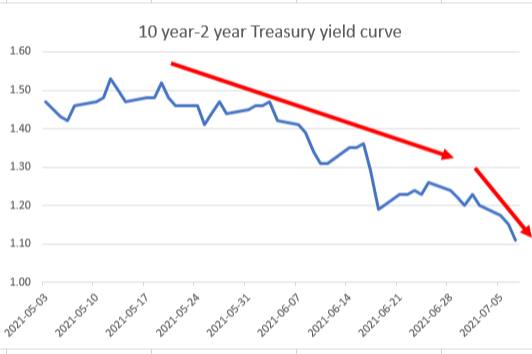

Long-term Treasury yields did collapse, and the yield curve flattened significantly. The stock market has also seen a corresponding trend: growth stocks/tech stocks have expanded their impact on value stocks/cyclical stocks.

This looks like a pattern. If something happens to suppress expectations of inflation, economic growth, or both, this is what you expect to see. However, there is not a lot of news-even tidy tabloids-to subtly explain why the downward trend and flattening of the yield curve that began in mid-May will suddenly accelerate. Let us see if we can sort out a clear signal.

First, the changes in yields (in the past few months and last week) can be divided into two roughly equal factors: a fall in inflation expectations and a fall in real interest rates (as shown by the yield of inflation-protected securities).

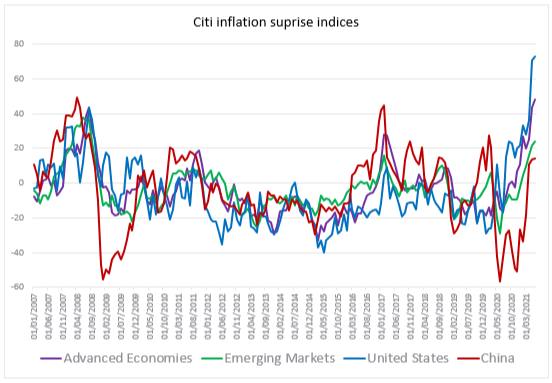

The decline in inflation expectations is difficult to justify. Yes, some key commodities have cooled down. Timber has almost normalized, and oil has receded from its OPEC-related tensions (the cartel seems unable to agree to a plan, and the market has concluded that this means that member states will eventually produce more crude oil). However, other than that, inflation data has been very hot. The following is Citigroup’s inflation surprise index for emerging economies, advanced economies, China and the United States. Everything is at its peak; the United States and advanced economies are at long-term highs:

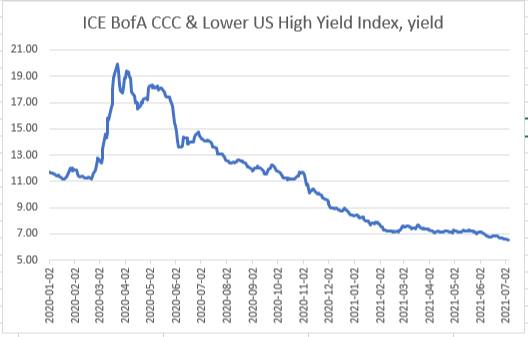

This is not the case with the plunge in yields: it is a signal that investors are turning to a “safe-haven” stance. Stocks, not just Nasdaq, which is dominated by technology stocks, are facing long-term highs. If this is not enough, Investors Intelligence’s bull/bear ratio is at a two-year high. Finally, the yield on the most junk bonds has never been lowered, and it continues to decline. Fed data:

Risk appetite is very keen.

Investors may be keen on risk because they believe that economic growth is not enough to justify the Fed’s tightening policy. Given the (perhaps blindly) mantra that low interest rates justify high stock valuations, this can explain the decline in yields, flattening of the curve, and soaring stocks. But recently there is not much data to justify the decline in growth expectations.June manufacturing with service The survey by the Industry Supply Management Association was slightly weaker than in May, but activity and orders remained high. The pressure seems to come from the supply chain, including the labor supply chain. But these problems should resolve themselves soon.

A more likely (if speculative) story about growth is that investors are only aware of the fact that growth is now peaking. As I wrote before, deceleration is not as interesting as acceleration, no matter how high the absolute level of growth is. When investors learn about the rise of the European Delta Virus, they may also begin to understand that the road to herd immunity may not be smooth sailing. However, neither the fact that growth always peaks in the middle of the year nor the news about the virus can really appeal to anyone. It should be priced more or less.

If bond yields fall and the curve flattens out, and neither falling inflation nor slowing growth is a particularly convincing explanation, there are still two possibilities. These changes may be attributed to “technical” factors-changes in supply and demand that reflect investor positioning and market mechanisms rather than fundamentals. Or they can reflect expectations that the Fed will mess things up. Let us proceed one by one.

In recent days, experts have provided many technical explanations for the direction of the market.I already written Regarding procyclical hedging for mortgage investors. Another currently popular technical reason is that pension funds are scrambling to reposition in response to the possibility of further decline in yields, or to take profits after risky assets have risen sharply. Then, as the summer vacation began, lack of seasonal liquidity was widespread.

However, it is difficult to know how to deal with these and other technical explanations. Experts who provide them are not inclined to provide them as trading ideas, for example as an argument that bonds are too expensive and will fall. Instead, they provide them with reasons to simply ignore the market changes discussed and move on tactically and strategically as before.

So we turned to the Federal Reserve. I think the central bank is very clear about its plan, but many people disagree. Anwiti Bahuguna, who manages a multi-asset strategy at Columbia Threadneedle, told me that although inflation and growth prospects have not changed much, the Fed’s lack of clarity has allowed the market to misprice policies.Traders simply don’t know how to understand the fact that the Federal Open Market Committee’s growth and inflation expectations have hardly changed, but their interest rate expectations, such as Dot plot, Obviously did it. “The Fed needs to explain if they will not react [to short-term inflation data] Why are these points moving? “

PGIM fixed income fund manager Gregory Peters agreed. He pointed out that since the Fed meeting last month, most of the decline in real interest rates has occurred, and investors have changed their expectations for future interest rate hikes. .

But why does it take weeks to price the internal contradictions of the Fed? The answer still exists. The world does not seem to have changed much, but the market continues to change.

A good book

Michael Pettis, Professor of Finance, mentioned here before, Wrote an interesting tweet line The dilemma faced by Chinese officials as they seek to solve the national pension problem by raising the retirement age.He explained the potential economic imbalance very well This Article a few years ago.

[ad_2]

Source link