[ad_1]

A new survey of leading academic economists by the British “Financial Times” shows that rising inflation will force the Fed to raise interest rates at least twice before the end of 2023.

This Employment survey A survey conducted by the Financial Times and the Global Market Initiative of the University of Chicago Booth School of Business suggests that the path of monetary policy may be more hawkish than the Federal Reserve Chairman Jay Powell suggests.

Economists’ views are closely aligned with the “dot plot” predicted by Fed officials, that is, as the U.S. economy rebounds from the pandemic and inflation is ahead of the long-term, interest rates will have to rise from the current near-zero level to when and how quickly . The average duration of the Fed’s target.

Post the latest bitmap and send a Bumps Through the market earlier this month, because policymakers have advanced the expected interest rate hike, but Powell and other members of the Fed’s leadership Later intervened Insist that they will patiently keep monetary policy highly accommodative.

The FT-IGM US Macroeconomist Survey conducted a survey of 52 academic economists, investigating the possibility that the Fed’s main policy interest rate will indeed increase by 0.50 percentage points before the end of 2023, as shown in the dot chart. Most people say that the possibility of taking this scale or larger relocation is more than 75%, while most people think that the possibility is as high as 90%.

Three economists said this is affirmative.

The survey emphasizes challenge Facing the central bank, convey a clear message on its changing monetary policy stance. Powell warned that the dot-map forecast for future interest rate hikes should be “reserved,” but other officials have begun to float the earlier timetable for the first interest rate hike.

Alan Blinder of Princeton University said: “As inflation rises and the economy improves, the traditional eagle-pigeon disagreement between the Federal Open Market Committee will reappear,” he participated in the investigation in the 1990s. “You are seeing it now, you will see more.”

Blind said he expects to raise interest rates as early as 2022.

It’s hard to think of a more pro-inflationary environment

Respondents to the FT-IGM survey believe that inflation is the biggest driving factor for Fed officials to change their views on the timing of interest rate hikes, and that inflation is the main factor that is more frequent than the improvement of the US job market prospects or housing price increases.

The surge in consumer prices this year has even exceeded some of the highest estimates. As the strong demand for goods and services in the economic improvement conflicts with extensive supply chain restrictions, the core PCE, the inflation indicator targeted by the Fed, ran at an annual growth rate of 3.4% in May, the highest level in 29 years.

The FT-IGM survey was conducted from June 25 to June 28 and will be conducted regularly throughout the year, indicating that economists are highly concerned about the risk of rising inflation. The median forecast of the survey respondents for the core PCE at the end of this year is 3%-the same as the median forecast of Fed officials.

But two-thirds of the respondents said that by the end of 2022, this indicator is “somewhat” or “probably” still exceeding 2%. The median forecast by Fed officials is 2.1%. It’s the end of the year.

Stanford University economist Nicholas Bloom (Nicholas Bloom) who participated in the survey said: “It is hard to imagine an environment that is more conducive to inflation.” “The Federal Reserve has been very active in promoting growth and its fiscal policy is incredible. The land is relaxed, and supply is restricted.”

Although Bloom’s “perfect storm” has taken shape to push up consumer prices, he dismissed concerns about the long-term loss of control of inflationary pressures, especially because the Fed is ready to act.

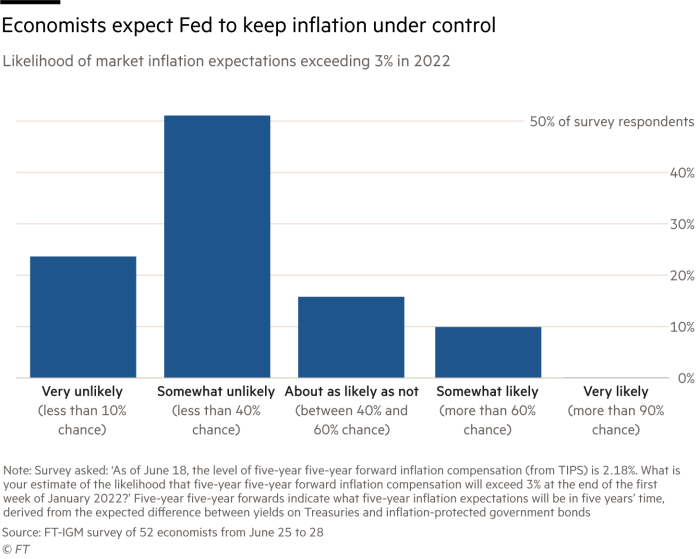

Three-quarters of FT-IGM survey respondents said that by the beginning of next year, market expectations for long-term inflation are unlikely to rise significantly above 3%. The current expected long-term inflation rate is 2.3%.

Another interviewee, Karen Dynan of Harvard University, said: “An important part of the Fed’s credibility is responding to incoming data.”

The central bank has already begun to discuss when to start scaling back its $120 billion monthly asset purchase plan, and officials have pledged to maintain the plan until they achieve “substantial further progress” towards achieving the goal of 2% average inflation and full employment.

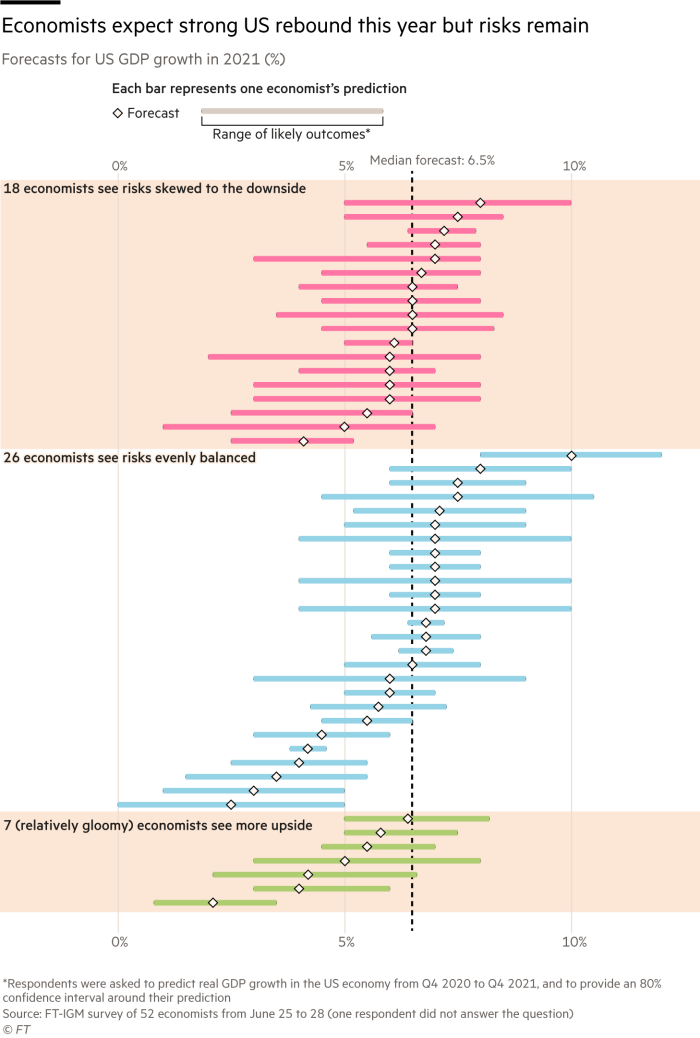

The FT-IGM survey shows that there are major differences in the outlook for economic growth in 2021, even if there is nearly half of the time in the rearview mirror.

After the 3.5% economic contraction last year, the median forecast is a 6.5% rebound in GDP. But economists are also asked to list a reasonable range of results, and these results tend to be downward rather than upward.

The difference in height indicates “the speed of the rebound in the service sector, whether labor market shortages will hinder growth, and how savings will [and] Allan Timmermann, a professor at the University of California, San Diego, said he helped design the survey.

[ad_2]

Source link