[ad_1]

In Akron, Ohio, house prices have risen 10.1% in the past year. In Albany, New York, the increase was 11.7%. Albuquerque, New Mexico, also experienced a similar 11.6% surge.

This is just a U.S. city starting with A.

Ali Wolf, chief economist at Zonda, a California real estate market research firm, said: “You can throw a dart at the map. It doesn’t matter where it falls, because the real estate market there may be very hot.”

When the coronavirus pandemic first struck last year, many politicians initially assumed that the economic pain would be shared. This epic event will be a great balancer. However, as governments in developed countries stepped in to protect their incomes in the best way to help those with stable jobs, difficulties have fallen disproportionately on flexible low-income workers and young people. Suddenly unable to eat out or travel, wealthier families have used last year’s savings to save.

According to a report released by Credit Suisse this week, the total global wealth accumulated by households in 2020 has increased by approximately US$28.7 trillion. Very out of touch Between this growth and the fate of the wider economy.

The wealthier households spend their windfall in stocks and cryptocurrencies, Louis Vuitton handbags with Dutch master. But most importantly, they have Spend money to buy bigger and better houses.

“People didn’t expect this to happen. James Pomeroy, an economist at HSBC, said that the timing will not start until a few months later because there are clear winners and losers. Now, the sharp rise in house prices represents “A huge challenge-the issue of financial stability, but also a huge socio-economic issue.”

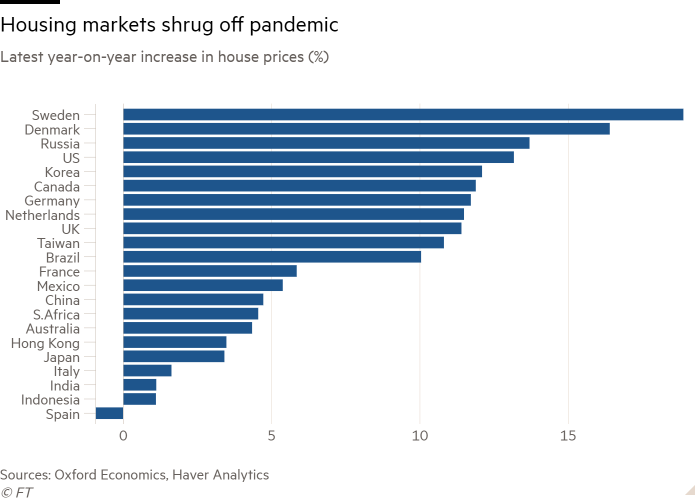

This phenomenon is global. The largest increase was in the United States. Data released this week showed that the median price of all housing types rose by 23.6% year-on-year in May. Daryl Fairweather, chief economist at online real estate brokerage firm Redfin, said that most American homes now sell for higher than asking prices, and the time to accept offers after listing is shorter than before the pandemic.

But even in Japan and Italy, where an aging population limits demand, price growth is accelerating.As the ultra-loose monetary policy keeps borrowing costs down, house price inflation is now at double digits In many advanced economies, From Sweden to South Korea, from Canada to the Netherlands and New Zealand-the largest increase was not the capital, but Suburbs, small cities and rural areas.

Norwegian Central Bank Said last week Oslo saw its first net outflow of residents in 20 years in 2020, as remote workers moved from apartments in the city center to more spacious houses on the outskirts of the capital.

In the UK, news report of G7 leaders meeting in the Cornish resort of Cabis Bay Enlighten The buyer’s agent Henry Pryor said that in the scenic southwestern region, the market here is “crazy” and this is a new wave of house hunting. “A customer left London to make a deal in Cornwall, and after a 40-minute drive they were told to turn around because it was sold,” he added.

Widening gap

The strong housing demand was initially welcomed-and encouraged by some state governments in the United Kingdom, the Netherlands, and Australia, which provide tax breaks to maintain economic development. Luis De Mello, head of housing research at the OECD, believes that while economic restructuring is underway, an active housing market is needed because “the barriers to housing mobility have become obstacles to our economic recovery.”

But the out-of-control market has brought two concerns to policymakers.First, prices may spiral into the bubble zone, making the economy vulnerable to sudden market adjustments Family wealth.

“I am not satisfied with rising housing prices, because real estate is the most reliable indicator and the most compelling leading indicator… a collapse,” said Adam Posen, director of the Peterson Institute for International Economics.

Second, for young people and key workers who have been turned away from many areas before the pandemic, home ownership may become more unaffordable-deeply rooted Inequality Between generations, and those who can more or less rely on the help of their parents.

“The activities we see are mainly people who already have a place in the real estate market. They are’rich people’,” said Neal Hudson, a British housing analyst.

Pomeroy said: “House prices are rising every year, the gap between the rich and the poor widens, and the gap between the elderly and the young is getting bigger and bigger,” he added, adding that the “mathematics of buying a house” has gotten worse in the past year because of the younger generation. People suffer at work. The loss and interruption of education may affect their lifetime income.

These two issues are getting more and more attention from policy makers. The real increase in demand for housing comes from domestic workers who are hungry for space, driving up prices. But there are also signs that financial speculation is starting to push up prices in markets where affordability has become an issue.

“What we often see now is that in many such house auctions, the winning bidder is sometimes not a family. This is a post office mailbox in Delaware. This is an investor who has never seen a house and wants to The house is renovated and ready to be bought for investment purposes and then rented out,” said Robert Kaplan, president of the Federal Reserve Bank of Dallas. At an event this week.

Black stoneThe private equity firm, which has become the world’s largest real estate management company, said this week that it will spend $6 billion to acquire American Family Partners, a buyer and operator of single-family rental properties.

Kaplan said he believes it is time for the U.S. central bank to reconsider its support for the real estate market. Buy 40 billion US dollars of institutional mortgage-backed securities every monthAccounted for a large part of its $120 billion bond purchase plan.

The Norges Bank hinted last week that it might tighten monetary policy soon, partly to curb unpopular housing price growth. New Zealand broke orthodoxy this year and added a clause to its central bank’s responsibilities directing it to adopt Housing prices should be considered when formulating monetary policy.

The President of the European Central Bank, Christine Lagarde, was also asked about this question-which has become a lightning rod for criticizing the European Central Bank. The European Central Bank’s ultra-loose monetary policy ——At the hearing held in the European Parliament this week.

In response, Lagarde stated that “there is no obvious sign of credit pushing a real estate bubble in the entire Eurozone,” but she added that some countries, especially some cities, have “residence real estate vulnerabilities”.

She said: “The disconnect between housing prices and broader economic development during the pandemic creates the risk of price adjustments,” she called for macroprudential policies—such as state restrictions on mortgage lending—to be “designed carefully to deal with specific National risk”. When asked this month about the risk of monetary policy fuelling a real estate bubble, Lagarde said that the benefits of the European Central Bank’s decision “to a large extent outweigh the indirect effects.”

Tax the rich?

Although central banks worry about financial stability, higher housing prices have sparked political debate about the possible impact of the pandemic on economic inequality.

In Berlin, shortly after the establishment of the German Constitutional Court, renters took to the streets last month, calling for the expropriation of property owned by commercial investors Ruled that the city’s rent cap was illegal.

In the UK, after temporarily cancelling evictions this month, debt charities called on the government to step in to help resolve the 360 ??million pounds of rent arrears accumulated due to the pandemic.

In the United States, although price increases are good news for many homeowners, they are devastating to potential low-income buyers and renters.

“Families who have survived the crisis without financial difficulties are snapping up a limited supply of homes for sale, pushing up prices and further excluding less affluent buyers from buying homes,” report The research from the Harvard Joint Center for Housing Research ended in June. “At the same time, millions of families who lost their income during the work stoppage were unable to pay for their housing and are on the verge of being eviction or foreclosure.”

Although the Biden administration decided this week to extend the national moratorium on evictions until the end of July, the situation for renters is also very bad. According to recent data from the U.S. Census Bureau, nearly 4.2 million people across the country expressed concern that they will face eviction or foreclosure within the next two months. The Think Tank Urban Institute warns that the burden will fall disproportionately on blacks, indigenous and Latin Americans, and other people of color.

However, Posen pointed out that the increase in housing wealth in the past year will help the American middle class catch up to the top of the distribution-while staying away from the poorest. Higher house prices are one of the reasons why most Americans today are better than before the coronavirus outbreak. “Is this an equal victory or an unequal victory? It depends on where you draw the line,” he said.

He said that if central banks want to prevent a dangerous bubble in housing prices, they should “headwind” and take measures such as restricting high-risk mortgages. But he added that the remedy for inequality lies in fiscal policy. Those who made excess profits through the pandemic should now face a “solidarity tax” to help pay.

“If you care about inequality, you have to redistribute directly-no deus ex machina will solve this problem for you.”

Additional reporting by Martin Arnold in Frankfurt and George Hammond in London

[ad_2]

Source link