[ad_1]

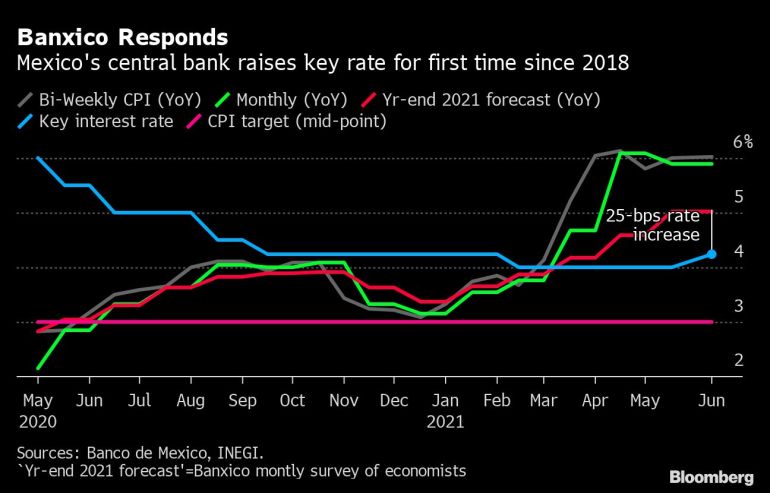

In response to the surge in inflation, Bank of Mexico raised its key interest rate by 25 basis points to 4.25%.

after Max de Haldevang and Maya AverbuchBloomberg

The Bank of Mexico unexpectedly increased borrowing costs for the first time since the end of 2018. This is because people are increasingly worried that rising inflation may threaten an economic rebound.

Banco de Mexico raised its key interest rate by 25 basis points to 4.25% in response to what policymakers previously described as a temporary surge in inflation. The decision was supported by three of the five-member board of directors, which surprised all 23 economists surveyed by Bloomberg, who originally expected the bank to hold a 4% stake. Data released on Thursday morning showed that inflation further accelerated to 6.02% in early June, which also surprised analysts.

As we all know, the central bank Banxico has set an inflation target of 3%, with a fluctuation of 1 percentage point.

“Although the shocks affecting inflation are expected to be temporary, given their type, scale and long time span affecting inflation, they may pose risks to the price formation process,” Banxico’s board of directors said in a statement accompanying the announcement.

The bank now expects the headline inflation rate in the third quarter of next year to converge to the 3% target, one quarter later than previous estimates.

After the announcement, the Mexican peso rose 2%, leading the rise of emerging market currencies.

Gabriela Siller, head of economic analysis at Grupo Financiero BASE, said: “This move provides the possibility to raise interest rates by another 25 basis points.”

The Mexican economy shrank by 8.2% last year, the largest contraction in nearly a century, and because the government maintained a tight fiscal policy, the bank’s easing policy was the only substantial form of economic stimulus during the crisis. So far, the economy has rebounded faster than expected in 2021, adding to inflationary pressures, and the bank is expected to grow by 6% this year.

Compared with the previous year, the inflation rate in April this year reached a peak of 6.1%, but it has hardly declined since then, which complicates the central bank’s task after initially stating that the inflation spike will be temporary. Prices have been pushed up by supply shocks and U.S. inflation.

Thursday’s decision was made since President Andres Manuel Lopez Obrador nominated the Minister of Finance after the current leader Alejandro Diaz de Leon resigned at the end of the year. Arturo Herrera’s first decision since he became Banxico President.

[ad_2]

Source link