[ad_1]

This article is a live version of our trade secret newsletter.registered Here Send the newsletter directly to your inbox every Monday to Thursday

Hello, from London, the mood there is as changeable as the weather. Mainly because it is unclear whether the Covid-19 Delta variant will destroy the dream of a more normal summer, or will prove to be a shorter and less destructive third wave.

Our main part focuses on another issue that affects public life: Brexit. Specifically, there are some weird differences between the trade data produced by British statisticians and EU statisticians, namely, how much the severance of ties affects exporters. Either way, the picture is not very good. But how bad the reality is depends on which side you believe in.

We hope to hear from you.Send any ideas to [email protected] Or email me [email protected]

The unexplainable gap is disturbing either way

With four months of UK-EU trade data, we should have a clearer understanding of the impact of the new trade relationship that took effect on January 1. Unless we don’t have one.

The reason is that data from the UK and the European Union paint a very different picture of trade flows across the strait. We cannot say with certainty that in the first four months of this year, UK merchandise exports to the EU have fallen by 4.8% compared to the same period last year, as the National Bureau of Statistics shows, or plunged by 27.1%, because Eurostat Data claims regarding EU imports from the UK.

Trade flow data are never perfect—for example, it’s normal for the gap between measurements of changes in import flows from the EU to the UK to be small. However, Eurostat and the National Bureau of Statistics of the United Kingdom disagree in estimating changes in the flow of goods moving in the other direction, which indicates a serious problem.

In fact, Thomas Sampson, associate professor of international trade at the London School of Economics, described the discrepancies between UK and EU trade statistics in 2021 as “very worrying”.

He added that, without being clear, it is impossible to say how burdensome the trade barriers introduced by the EU-UK Trade and Cooperation Agreement proved to be. Or whether a particular department needs additional help to deal with the new export friction. Well, it is not good for policy making.

So what’s wrong with this? One possible culprit is a change in the way data is collected since January 1.

The National Bureau of Statistics of the United Kingdom explained that although its UK import data from the EU continues to be collected through the EU’s Intrastat system, all other data is now obtained through customs declarations.

“In view of the changes in export data, the difference between Eurostat and National Statistics Office trade data will mainly be reflected in export data, rather than imports from the EU,” Hannah Donner, Co-Head of Trade and Tourism, National Bureau of Statistics of the United Kingdom Hannah Donnarumma said.

Although this is certainly true, why does relying on customs declarations produce such different results?

The statistician is a bit confused. Sampson tells us that the reason for the difference in data collection methods is “not obvious.”

The Office of National Statistics of the United Kingdom provides a broader explanation of the differences between EU and UK trade data.

The headline data for the United Kingdom is seasonally adjusted, while the Eurostat data is not. The UK data is also based on the balance of payments, which means that they are only counted when ownership is exchanged. At the same time, the European Union treats any cross-border transaction-known as the basis of International Commodity Trade Statistics (IMTS)-as a trade flow. Therefore, if a company ships car engines from the UK to its French subsidiary, it will appear in the EU trade statistics, but not in the UK trade statistics.

However, UK HM Revenue & Customs releases trade data based on IMTS, and they show similar trends to ONS data. Neither of these two factors explain why there is such a large gap in exports from the UK to the EU or imports from the UK to the EU from the other side’s perspective.

Therefore, there is still a big mystery as to what happened.

The National Bureau of Statistics’ decision to change its data collection methods has also been criticized in some respects. Sampson told us that the UK’s implementation of the new trade agreement while making the transition “is undoubtedly a mistake.” He also said that although the government warned that this would cause problems with the consistency of the data series, the conversion was carried out.

Michael Gasiorek, director of the UK Trade Policy Observatory at the University of Sussex, pointed out that he “don’t know why” the two sets of data collected by the UK’s National Bureau of Statistics are used for trade between the UK and the EU-one set shows the entry of goods. The other set of out-should be based on different collection methods. However, he believes this is almost certainly because the UK has not yet conducted a comprehensive border inspection and may not be able to collect data properly.

Another unresolved question is which set of statistics more accurately reflects the extent of damage to British exporters caused by Brexit.

“We really need to know what is the driving factor of the difference in order to know which data is more’trustworthy’,” Gasiorek said. At the same time, he invited policymakers to consider two sets of data to at least obtain “a reasonable set of results” from changes in the trading system.

Although we are not sure that UK exporters’ sales to the EU have fallen by 5% or almost six times this figure in the first few months of 2021, it is clear that the new arrangement is not good news for UK exporters. Samuel Tombs, chief British economist at Pantheon Macroeconomics, stated that no matter what kind of data is used, the UK “has missed opportunities for global trade growth because of Brexit”.

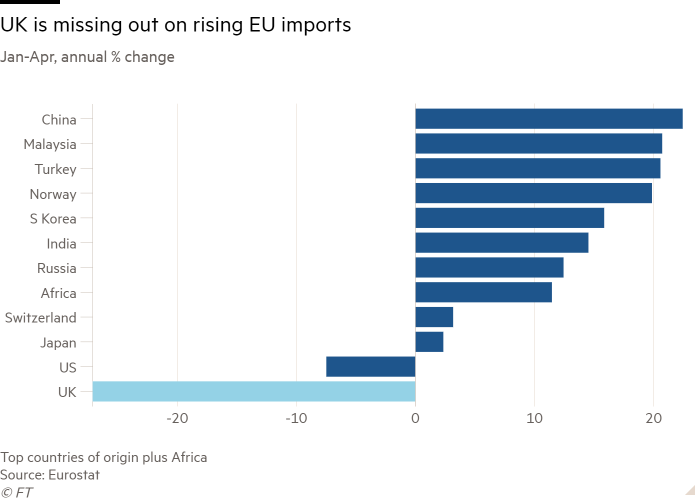

It is especially distressing that, according to Eurostat data, the EU’s imports from China and most other major trading partners achieved double-digit annual growth rates in the first four months of this year.

In the next few months, as Covid restrictions across the EU are relaxed, opportunities will continue to increase. Although the gap between statisticians is so large-trade data from the United Kingdom and the European Union indicate that British exporters will suffer losses due to the interruption of Brexit.

Trade ties

Container freight Some major arteries in the world have soared again. The reason is: the outbreak of Covid cases in China has led to the closure of the world’s third largest container port.Harry Dempsey and Thomas Hale See the impact Is interrupted at Yantian, Shenzhen, In the global supply chain.

South Africa Yes Tune into The first one to live in Africa mRNA hub, This may produce a Covid vaccine within a year.

Nikkei Index ($) Delve into Another reason for the surge in global commodity prices: Supply is tight due to stagnant mining operations and distribution services.it is also report Due to the united front against China, India and Europe are getting closer to each other. Claire Jones

[ad_2]

Source link