[ad_1]

This article is a live version of our Unhedged newsletter.registered Here Send the newsletter directly to your inbox every business day

Summer really feels here, and I feel great. I must have missed something. If you know what it is, please email me: [email protected]

Shocked by the obvious

Last week, the market threw some toys out of the stroller. Let’s review it.

As the market adjusts to the Fed’s new interest rate stance, the yield curve has flattened sharply (all data below are from Bloomberg):

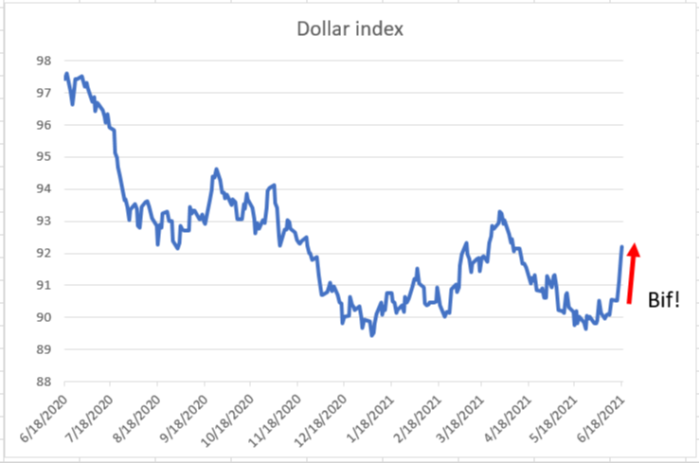

As expected short-term interest rates rise, the dollar soars:

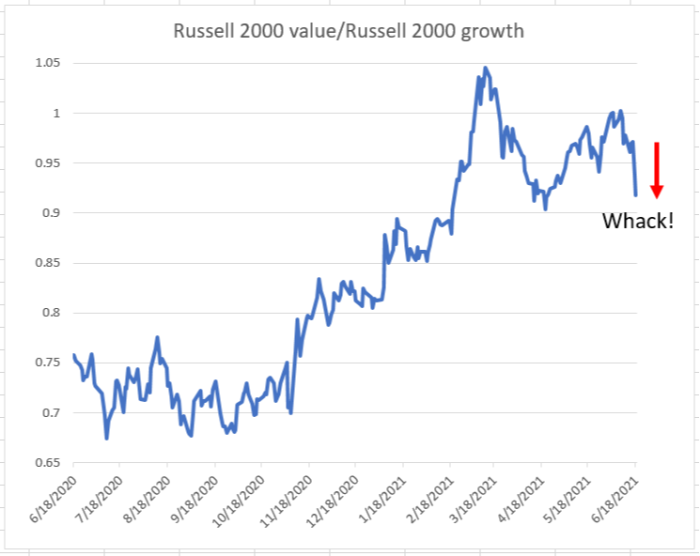

Investors abandoned reinflation trading and sold cyclical value stocks in favor of growth stocks that are expected to stand out in a low-growth world:

Stocks usually also have some volatility. As the market fluctuated, the market quickly formed a consensus that the Fed had a “hawkish surprise” on Wednesday. The story goes like this: After discussing the new inflation target mechanism for several months and how to tolerate inflation exceeding the target for a period of time, the Fed’s dot plot shows that the members of the Open Market Committee are much tougher than their previous ones. Let’s go.

The bitmap that inspires this bitter sense of betrayal is shown below:

-

Seven of the 18 members believe that interest rates will increase in 2022, compared to four before;

-

Thirteen members believe that there will be at least one interest rate hike in 2023, compared to 7 before; the average member expects two interest rate hikes, between 0.5% and 0.75%.

I talked to Rick Rieder about the market’s reaction. As BlackRock’s fixed income chief information officer, he is responsible for nearly $2 trillion in bond portfolios. He described the shock and crazy adaptation of the market:

In terms of the Fed’s actions as much as they have done, this is an extraordinary surprise because it is completely different from what they have said so far. The way those points move forward. .. You must think that the leadership is happy to tighten up as quickly as possible.

As I have seen, it is as large as the technical closing of the position-an extraordinary liquidation.

He described a situation in which almost everyone is on the side of steep curve transactions and other transactions related to it:

The liquidity of the market is very thin. Usually when people see high transaction volume, they think there is a lot of liquidity, but at any given price, liquidity is very shallow. Every time you do something, it will drive the market. No one wants to be on the other side of these transactions.

The same place was crowded with people, and mass relaxation followed. .. In a world with so much social media and everything else, everyone can line up on one side, and when things change, it really disrupts the Apple shopping cart.

However, he doesn’t think the Fed made a mistake: “This is totally appropriate, and I think the Fed is doing the right thing.” This sums up the situation perfectly. The Fed said something. The market was seriously out of control and fell into consensus trading, frightened. But the Fed said what should be said.

More importantly-I disagree with Reid here-considering what the Fed has said in the past and what has happened in the past few months, what the Fed has said should be completely unsurprising.

As expected, the Fed kept its policy unchanged. The chairman made it clear that the committee as a whole expects inflation to be temporary and therefore believes that it is not even necessary to discuss interest rate hikes at this time, but the optimism about the return of employment means that at some later point, it will be felt to discuss the gradual reduction of asset purchases. Given that the core CPI data of the past two times were 3% and 3.8%, this is a mild and mild thing.

As for those points, they delivered a shocking message. As CPI, wages, employment, commodities, housing, and other six aspects heat up, Maybe The rate will have to be fine-tuned A year or more from now, with Maybe Nudge a little in the next time Two and a half years. Friends, this is what it looks like to be more tolerant of inflation above the target.

Considering what the Fed is saying and the data it sees, the market that is surprised is a market that is out of touch with reality. It wants growth, inflation, sky-high asset values, and short-term interest rates close to zero, and they will always want it all. When Santa didn’t provide all of these, there was a pony, and he panicked.

The difference between a market that panicked because the Fed changed its position and a market that returned to reality because the Fed acted rationally is important. If you believe that what we have just seen is the former, then you may hope that in the future some better-calibrated and more precise telegraph actions by the Fed will keep the market calm. But this will never happen, because a market that is out of breath will not be happy. If we are to return to anything similar to normal policy, the Fed will drag down the market’s chaotic overreaction to obvious facts.

Of course, you can argue that it is difficult to fully recover from a very loose monetary policy, which proves that the Fed’s entire approach is wrong. Or you can argue that the dot plot is a mistake, or the Fed’s policy should be driven by mechanical rules rather than judgment. All of these may be true.

However, if you think that the Fed has just made a tactical or operational error, rather than being misled strategically or philosophically from the beginning, then it shows that you are spraying the same glue as everyone else.

A good book

Late last week, the Wall Street Journal had a very good Review The impact of retail traders—now accounting for 20% or more of trading volume—on the U.S. stock market. This thing is not a joke.

[ad_2]

Source link