[ad_1]

The commodity boom has been hit this month. Although there are still many reasons to bet on the so-called super cycle, it is unlikely to be smooth sailing.

Plenty of stimulus measures, the reopening of the economy from the pandemic, and strong demand in China have driven soaring prices of raw materials this year, some of which hit record highs. However, due to a stronger US monetary policy tone, China’s efforts to reduce inflationary pressures, and improved crop weather, they have declined in the past two weeks-some of which offset this year’s gains.

Although this has blown away some speculative bubbles in the market, the biggest question is whether the latest commodity bull market has passed its peak or is it just a breather.

Either way, the direction may not be broad, and each market has its own push and pull levers. Copper traders need to strike a balance between China’s short-term cooling and long-term green energy prospects. The decline in oil prices may be constrained by falling inventories and supply concerns, iron ore is being hit by Chinese policy, and gold will be largely governed by when the Fed starts to scale down.

“I can still see a lot of inflationary pressure in the supply chain, and the reality is that it is rising,” said Michael Widmer, head of metal research at Bank of America Merrill Lynch in London. “From the perspective of commodity prices, I can see the structural argument that prices continue to stay high or go higher.”

copper

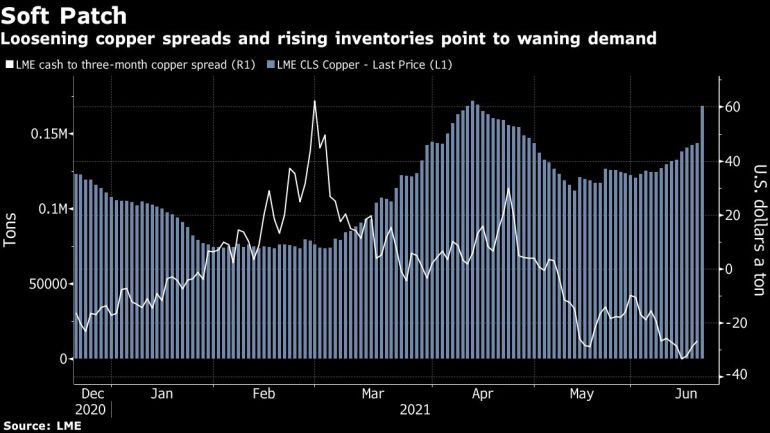

The record one-year rebound in May was triggered by a surge in Chinese demand, but there are signs that manufacturers’ orders are beginning to decrease.

The bulls are confident that the rest of the world will fill the vacancies as renewable energy and electric vehicle investments make a step change in demand in Europe and North America. Nevertheless, it may take some time for expenditure to enter factory orders, and weak demand may encourage shorts, who say that the current high prices are not justified by the fundamentals.

iron ore

Iron ore is currently the most volatile commodity, and it may be particularly difficult to predict its trend. It soared to record levels, fell into a bear market, and then rebounded back to a bull market within a few weeks, as traders struggled to cope with the bleak outlook for demand in China’s major consumer countries.

Both the bulls and the bears are paying close attention to China’s simultaneous goal of curbing inflationary pressures caused by high commodity prices and making the huge steel industry more environmentally friendly. The country’s steel production is still expected to hit another record this year, which may prompt the authorities to take further action to restrict production and re-wash the iron ore.

agriculture

Showers in the US corn belt and uncertainty in biofuel policies have caused the recent crop market to plummet, but more rain is needed to ensure a bumper harvest for one of the world’s top suppliers. After the record heat wave, more than one-third of the corn and soybean acreage in the United States is suffering from drought.

This is the China story on the demand side. The country’s huge imports have driven crop and hog futures soaring in the past year. Major traders such as Cargill Inc. and Viterra said that the crop market is in a “mini super cycle” that may last for five years, driven by increasing demand for biofuels and China’s continued procurement.

oil

The focus has shifted to the speed at which demand recovers in the summer. Although there are signs that the United States is leading the way with the reopening of Western economies, the spread of the Coronavirus Delta variant that was first discovered in India is reigniting concerns about consumption paths in parts of Asia.

At present, the market seems to need additional supply in the second half of the year. OPEC+ Group has not confirmed its production plan after July, and US shale oil producers continue to promote discipline when they make money again. More importantly, as negotiations with the United States continue, when the market will see such a strong focus on the restoration of Iranian supplies.

Gold

Compared to any other commodity, gold is more susceptible to the actions of the Fed. After the U.S. central bank hinted that it might start tightening monetary policy earlier than expected and the dollar rose, the index fell to its lowest level since early May.

Although buying precious metals is usually to hedge against inflation, the Fed said this week that it will not allow higher-than-expected inflation to persist, which opens the door to faster stimulus reductions. This weakens the attractiveness of interest-free gold. UBS expects the price at the end of the year to be US$1,600 per ounce, while the current price is about US$1,780.

-With the assistance of Annie Lee, Alex Longley, Megan Durisin and Eddie Spence.

[ad_2]

Source link