[ad_1]

The author is the co-founder and chief investment strategist of Absolute Strategy Research

The investment system in the past two decades has been based on a capital-light business model, focusing on investing in faster-growing companies.

We see that this situation is changing. With the combination of short-term capacity pressures and long-term structural themes, capital-intensive models and investments in companies that are currently considered undervalued stand out.

Light-capital enterprises not only rely on globalization and information technology outsourcing labor, but also rely on capital investment in fields such as machinery and equipment. Intellectual property and intangible assets have become the driving force of profitable growth and market value.

The “platform company” that connects customers and suppliers has become the ultimate manifestation of this information-heavy/capital-light business model. Capital-intensive companies that were favored by “value” investors in the past are in trouble.

We see that the policy response to the Covid-19 pandemic may change the investment system and thus the business model of the corporate sector. Monetary policy now puts full employment and inclusiveness ahead of inflation, while fiscal policy is increasingly expanding. The nominal GDP of the United States may grow by 10% this year, while achieving a mixture of growth and inflation that occurred in the 1950s and 1960s.

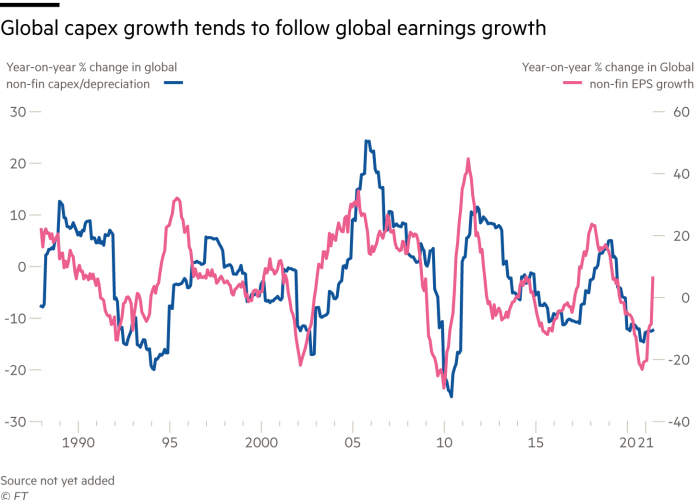

Such rapid demand growth will expose insufficient investment in capital-light businesses, leading to increased investment as the company seeks to rebuild production capacity. However, these short-term pressures will only accelerate the transition to a long-term system of capital-intensive business models.

The trend for more capital-intensive companies is driven by four structural themes: “return” investment; shift from information investment to infrastructure investment; need to develop climate transformation technologies and ultimately invest in the technologies needed to ensure geopolitical leadership . These need to change from investing in ideas and information to investing in things.

Backflow is an investment in independence and flexibility. The financial crisis and Covid-19 have exposed the fragility of long and thin supply chains. Governments of various countries are paying more and more attention to supply chain security to ensure network security, biosecurity, financial security and national security.

Some companies have recognized the potential benefits.Tesla description It is “absurd vertical integration” in itself to ensure rapid growth and make it difficult to copy its vehicles by purchasing from supplier catalogs. Amazon also invests in controlling its end-to-end business, with its own network services and air cargo operations.

Investing in infrastructure rather than information is the subject of governments, companies, and investors.Global Infrastructure Center estimate In the next 20 years, global infrastructure needs 94 trillion U.S. dollars of investment to keep up with the demographic structure and replace aging infrastructure. After decades of neglect, this will boost demand for commodities and capital-intensive companies.

At the same time, climate transition technologies will require investment in a range of areas.More extensive transportation electrification needs to be Battery technology with Hydrogen fuel cellHowever, transportation accounts for less than one-fifth of carbon dioxide emissions, so from steel production to agriculture, the entire economy needs innovation.

Competition for geopolitical leadership may also affect investment patterns. In the 1960s, the military-industrial complex was at the core of technological innovation and economic growth in the United States, which made it profitable to “piggyback” government investments in computing and aerospace.

Today, Chinese “Military-civilian integration” The plan aims to provide the technological advances needed to ensure geopolitical leadership. Beijing’s goals include closing the technological gap between aero engines and high-end semiconductors, and establishing a leading position in quantum computing. If the United States is to keep up with China, it needs to introduce capital into these areas.

Our conclusion is that the shift to a capital expenditure-intensive business model will initially be driven by capital-starved industries in the past 20 years, as they benefit from return and increased infrastructure spending. However, in the long run, the emerging technologies needed for climate transition and geopolitical “agent wars” may bring higher returns to investors in capital-intensive companies.

[ad_2]

Source link