[ad_1]

This article is a live version of Martin Sandbu’s free lunch newsletter.registered Here Send the newsletter directly to your inbox every Thursday

In addition to international tax reform (see “Other Readings” below), the main topics of current economic policy are Labor shortageThere are numerous reports that as the economy reopens and people return to shops, hotels, cafes and bars, companies are working hard to recruit.It seems that some people have even taken an unheard of improvement Pay to find employees.

This should be good news. But these stories are sparking a larger debate about whether the risks of overheating are beginning to outweigh the risks of stagnant growth—at least in the United States, where the Biden administration’s fiscal plans are much larger than what is happening across the Atlantic. In Europe, the imprint of a general labor shortage can easily undermine the provisional consensus to provide strong financial and monetary support to the economy.

Free lunch says don’t panic. There are a lot of reports about labor shortages, no need to worry. Today, we have summarized the reasons for you.

Except for data, you can see shortages everywhere

Not only in the United States and the United Kingdom, but also in many high-income countries, including the United States and the United Kingdom, many high-income countries have many anecdotes that companies have difficulty finding employees. Germany with NorwayHowever, look at the conditions of these economies.

Compared with pre-pandemic trends, the U.S. economy still lacks 10 million jobs (see chart below).In the Eurozone, Capital Capital Researchers Estimated “weakness” in the labor market — How big is the gap between it and full employment — 4 million people, twice the increase in unemployment during the pandemic. (Even so, some of us believe that the economy is far from reaching its potential).

Globally, the ILO says that the number of jobs will increase by 100 million this year, but this will still leave 75 million jobs are missingIn such a digital context, it is ridiculous to talk about shortages in the macroeconomic sense-it is dangerous to mistake partial austerity as a general manifestation of the need to withdraw the stimulus of aggregate demand. A study The study by the International Monetary Fund and other researchers on post-pandemic fiscal policy has just determined that premature withdrawal from finances after a pandemic will significantly increase inequality.

Price pressure: dogs that don’t bark

But isn’t inflation accelerating suddenly? Kind of-but does not indicate widespread price pressure in any way. The US consumer price inflation rate jumped to 4.2% in April (the personal consumption expenditure index targeted by the Federal Reserve rose by 3.6%, a moderate increase).Some of them are Due to the “foundation effect” — After prices were particularly low in the first wave of the pandemic, simply returning to the pre-pandemic price path would produce a snapshot of high inflation.

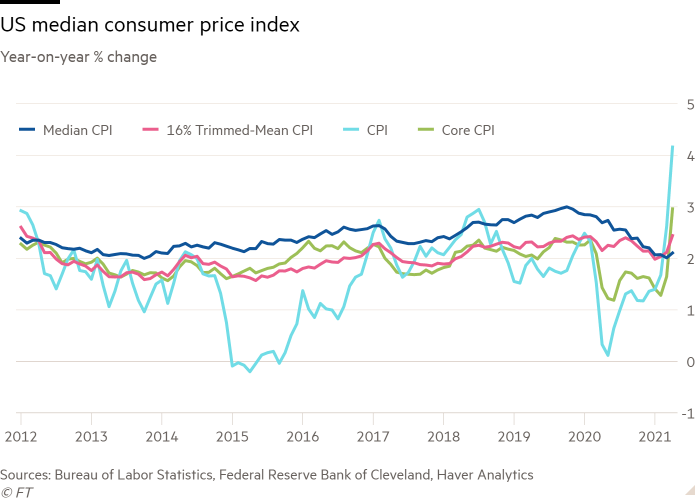

Certain sectors are bound to see dizzying price increases, such as timber, where U.S. prices are in these sectors More than four times. But to see that these are exceptions to the proof rule, look at the different inflation indicators.Cleveland Federal Reserve Median inflation indexThe inflation rate for commodity categories that measure prices rising faster than half of all commodities and slower than the other half is almost unchanged: 2.1%, which is exactly in line with the Fed’s target. The broader revised index, which measures the CPI but does not include the most extreme price changes of 8% in either direction, rose 2.5%.

In other words, although in a few cases (except wood, microchips and second-hand cars are often mentioned), the price increase is particularly large, but the prices of most things are in a healthy state.Can say something similar In other economies: Any increase in the headline inflation rate is below the surface.

This is especially true for wages. Media reports about employers having to pay more have suffered the same curse as most journalism: it focuses on the unusual, not the representative. It’s hard to find any signs that the prevailing wage pressure cooker is heating up. In the United States, average hourly wage growth is not particularly high (see chart below). In the UK, this is indeed the case, but only because the latest data (first quarter) coincided with the lockdown, in which low-income workers were disproportionately unemployed.To eliminate this combination effect, wage growth Looks very similar to before the pandemic.

In the United States, the Atlanta Fed’s wage growth tracker avoids an effect by looking at individual wage surveys and checking how everyone’s wages change. The chart below shows the median wage growth–the wage growth of people whose wage growth rate is more than half of the sample but slower than the other half in the same period–and the average wage growth rate of all individuals, as well as the 75th and 25th percentiles. Number of digits. You will have a hard time discovering where the shortages started after the pandemic they told us.

This is not to say that there is no salary pressure at all, if you look closely.In the American leisure and hospitality industry, wages are Obviously picking up quickly,As shown below. But this confirms the point: any price or wage dynamics we see are industry-specific effects of a mismatch between industry-specific demand and supply.

Will wage-driven shortages be a bad thing?

Therefore, if we look at the facts of labor shortages and prices correctly, we will portray a very localized pressure: due to economic restructuring, the pandemic has rapidly changed the needs of consumers and the places where workers want to work. It seems that the most difficult industry to recruit is the hotel industry. But this is the industry most affected by the lockdown. It is now trying to open up at a very fast rate, over-relying on migrant workers, and often providing sub-standard working conditions even at the best of times. If workers find better jobs elsewhere—the same anecdotal reports suggest that courier companies and supermarkets are snapping up workers—this is good news.

Of course, this may change: local wage dynamics may eventually become inflationary pressures for the entire economy. So this is the third answer. If the demand for workers is not met, it will indeed push up wages. What else do you dislike?As Annie Lowrey says, Maybe labor shortage is a good thing. It can transfer income from capital to labor in places where the opposite has happened over the past few decades, it can make the tide of labor market instability recede, and it can strengthen the motivation to increase labor productivity.

Of course, this will not be the result of the spiraling wage price in the 1970s, when wages rose unsustainably, causing inflation to be so high that it eroded their actual purchasing power. But this is not the 1970s. Subsequently, the world suffered a huge negative supply shock in the form of rising oil prices. The result is stagflation: production falls and prices rise. What we are told today to worry about is a huge positive demand shock. But all this is different.

Other readability

-

The G7 Finance Ministers agreed last week to reform international corporate taxes, I think In my Monday column The long-term push for transparency has created a political impetus for change. I was lucky: the next day, ProPublica Published a report Regarding the taxes paid by the richest Americans relative to their wealth.

-

Sylvie Kaufman Join the debate On how we should understand European identity Initiated by Hans Kundenani.

-

The Bank of England issued a New discussion paper Regarding the possible central bank digital currency (CBDC). It also summarizes the response to its inquiry, which shows that people are very interested in programmable currencies. One example that will definitely promote support for CBDC is the automatic compensation payment for delayed flights!

Digital news

-

According to Kristalina Georgieva, President of the International Monetary Fund, a carbon tax or emissions trading scheme covers 23% of global carbon emissions Said in a meeting last week.

[ad_2]

Source link