[ad_1]

The world economy is recovering, but the recovery momentum is mixed.This is the World Bank’s June Global Economic Outlook Is telling us. The main reason for the recovery is the success of the vaccine program. The main reason for the disagreement is the limitations of the vaccine program. Some parts of the world economy may become too hot, while other parts are too cold. So, stay vigilant.

This time it is indeed different: the economic recession is not caused by the need to curb excessive inflation, nor is it caused by the oil shock, nor is it caused by the financial crisis, but by the virus. Now, with the success of the vaccine program, the world is recovering from the strongest economic recession since 1945.

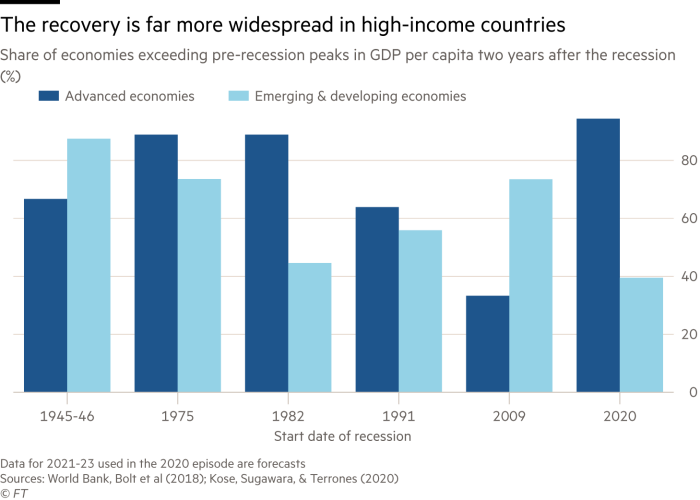

This is good news. The bad news is the degree of imbalance in the recovery. According to the Global Economic Outlook, 94% of high-income countries will recover their pre-recession GDP per capita within two years. This would be the highest share in such a short period of time after any recession since World War II. But it is expected that the proportion of emerging and developing countries that are expected to achieve this result this time will reach 40%. This will be the lowest share after the post-war recession.

The relative success of high-income countries is due to the scale of their fiscal and monetary policies and their Vaccine launchEmerging and developing countries are far behind in all these aspects. In high-income countries, quantitative easing accounts for an average of 15% of GDP, while in emerging and developing countries it is 3%. The average financial support for high-income countries is 17%, while that for emerging and developing countries is 5%. Even so, half of low-income countries are still in debt distress. David Malpass, President of the World Bank, said, “The pandemic not only reversed the results of global poverty reduction for the first time in a generation, but it also deepened the challenges of food insecurity and rising food prices for millions of people. “.British decision Cut foreign aid The budget is very outdated.

Given all this, the most important decision is Leaders of G7 high-income countries Funding is needed for the supply and distribution of vaccines this week. This will also benefit donors. If people are to be truly safe anywhere, they must stop the pandemic everywhere.

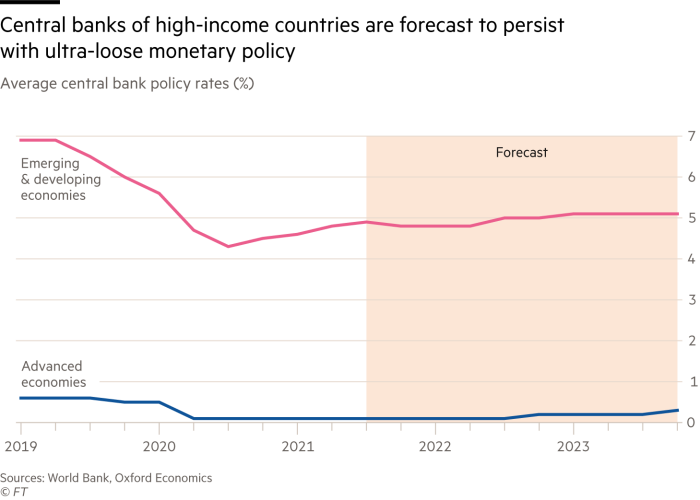

Among high-income economies, the most important growth engine is the United States, which has very aggressive monetary and fiscal policies.This Joe Biden’s budget proposal It is expected that the federal deficit for this fiscal year (to the end of September) will account for 16.7% of GDP and will reach 7.8% next year. Simultaneously, Most members of the Federal Reserve Board expect that interest rates will remain close to zero even by the end of 2023. These policies have brought huge benefits. But how big are their risks?

This caused a lot of controversy. This is not a purely local issue either. If the Fed has to raise interest rates significantly, it is likely to cause another major recession in the United States. This is not only bad for the United States, but also bad for the world, including vulnerable developing countries.

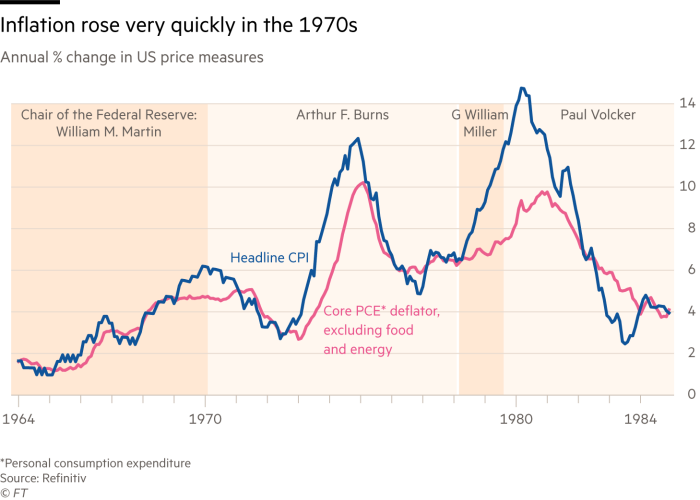

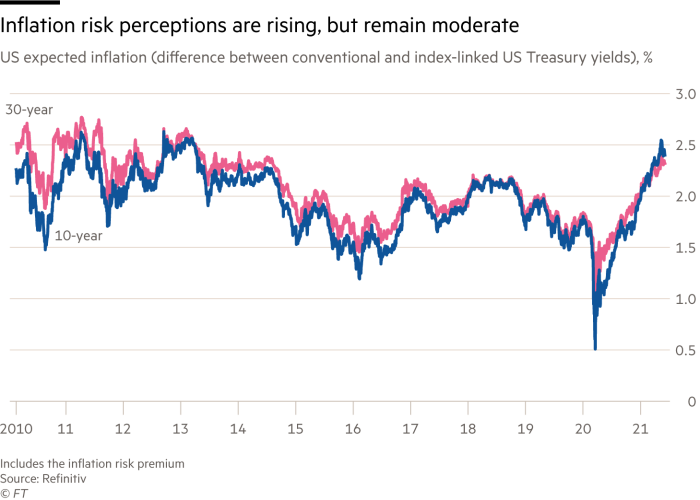

It is in this context that the debate on inflation is particularly important. Stephen Roach, who worked at the Federal Reserve in the 1970s, Recalling Arthur Burns, The chairman of the Federal Reserve who released the inflation sprite from the bottle in the early 1970s. If you repeat the same mistakes, almost everyone will pay a high price. But is this kind of result really possible?? The answer is yes-not because of what has already happened, but because of the Fed’s commitment.

As the Fed believes, the increase in inflation we are seeing may be mild and temporary, and will not affect inflation expectations. But the Fed has locked in its response too slowly, especially considering fiscal expansion.This is because, with Richard Clarida, Vice Chairman, “We expect it to be appropriate to keep the federal funds rate within the current target range of 0 to 25 basis points until the inflation rate reaches 2% (on an annual basis) and labor market conditions reach this level. [Federal Open market] Committee’s assessment of the largest employment”.

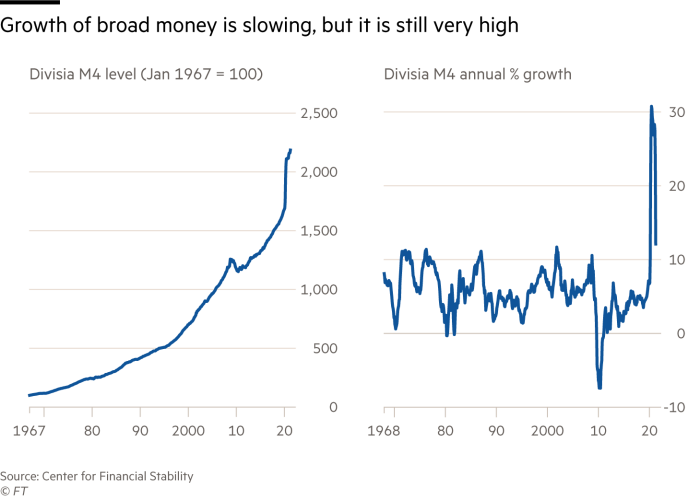

This is a “result-based” policy, not a “prediction-based” policy. What does it mean in layman’s terms? This means that the Fed will stick to its ultra-loose monetary policy until employment has reached the (unknowable) “maximum.” Given the lag between policy and results, this guarantees overshoot. By the time the economy finally reaches the point where the Fed begins to tighten policy, it will become hotter (under “maximum employment”) and will inevitably become hotter.

This is what happened in the 1970s. In that case, the necessary deflation was postponed until Paul Volcker took over in 1979. This experience is cruel. Given the inevitable lag between tightening and controlling inflation, costs may become severe again. This is irrelevant to the United States. Remember: the Volcker shock triggered the debt crisis in Latin America. This time, there was more debt almost everywhere. Severe monetary tightening will cause more damage than then.

Getting the whole world out of the pandemic crisis is far from complete. There is still a lot of work to be done in this regard. In addition, the world’s most important central bank’s new monetary policy is at risk of serious overshoot. By only reacting to the results, it is almost certain that the reaction is too slow. This may not matter, because no matter what happens, expectations remain well anchored. I pray that this will be the case. There is no need to think about alternatives too much.

[ad_2]

Source link