[ad_1]

In the otherwise calm financial market, government bonds and a handful of “memetic stocks” rose on Tuesday as investors waited for inflation data and weighed the heightened tensions between the United States and China.

The yield on the 10-year U.S. Treasury note, the benchmark for the global debt market, fell 0.04 percentage points to 1.528%, the lowest level since early March. Bond yield is inversely proportional to price.

The German equivalent of German government bond yields fell 0.03 percentage points to minus 0.226%, the lowest level in about a month.

These measures were initiated by U.S. President Joe Biden in a working group aimed at improving the resilience of the supply chain and transferred to Review of new tariffs Chinese rare earth magnets used in goods such as electric cars and smartphones.

“I think many investors initially expected Biden to take a more conciliatory position with China than with China. [former president Donald] Trump, but he took a pretty tough stance,” said Catherine Doyle, an investment expert at Newton Investment Management. “You also start to worry. [new coronavirus] variant. ”

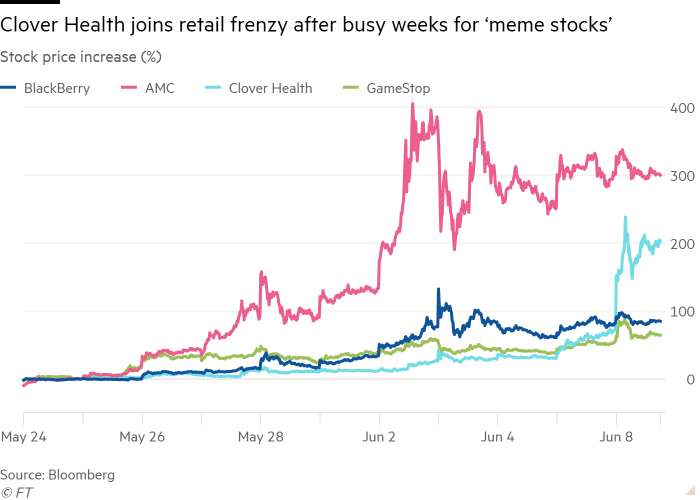

US and European stock markets were mostly volatile on Tuesday, except for a few meme stocks that attracted the attention of novice traders on online forums.

Clover Health, a medical insurance startup, went public in January through a merger with one of the venture capitalists Chamath Palihapitiya’s special purpose acquisition company, and its stock price rose 107.8% to $24.93 per share. They later fell back and closed at $22.15.

Ihor Dusaniwsky, managing director of data provider S3 Partners, said that despite this, the rebound resulted in “huge losses for short sellers.” In the past 30 days, short sellers have increased their stock positions by 24.5% because Clover Health’s stock price has risen by approximately 38%.

Video game retailer GameStop, which was at the center of the retail trading frenzy earlier this year, rose 22% to $345 on Tuesday, before falling back to $300 at the close.

However, other memetic stocks are calmer. Blackberry and AMC closed flat. The sharp rise last week brought the theater chain to a multi-year high of $72.62.

In most cases, traders are reluctant to place bets due to the “feeling that the good news has all come out” described by David Moss, BMO Global Asset Management Co-Head of Global Equities.

Wall Street’s blue-chip S&P 500 Index closed flat, slightly below its early May high, while the Nasdaq Composite Index of technology stocks rose 0.3%. After hitting a high on Monday, the Stoxx Europe 600 Index rose 0.2%.

Despite concerns about rising inflation in the United States, bond prices are still rising, which has eroded the returns of fixed-rate securities such as U.S. Treasuries.

The data released on Thursday is expected to show that after excluding the volatile food and energy costs, consumer prices in the United States in May rose 3.5% from the same period last year. This will represent the strongest year-on-year price increase since 1993, although Fed Chairman Jay Powell has believed for months that the outbreak of inflation will be the temporary impact of the reopening of industries following the forced closure of the pandemic.

“Investors’ concerns about U.S. inflation have become less serious,” Deutsche Bank strategist Jim Reid said after the announcement of global bond yields Rise sharply The first three months of this year.

In currency terms on Tuesday, the pound fell 0.2% to $1.4156 against the U.S. dollar amid growing concerns about the increase in coronavirus cases push back The British government will relax the deadline for blockade restrictions on the United Kingdom on June 21.

The euro fell 0.1% against the dollar to $1.217. The U.S. dollar index, which measures the U.S. dollar against the currencies of trading partners, rose 0.2%. Bitcoin fell 4.8% and traded at $32,789.

International oil benchmark Brent crude oil rose 0.9% to US$72.36 per barrel.

Unhedged-markets, finances and strong opinions

Robert Armstrong analyzed the most important market trends and discussed how the best people on Wall Street respond to these trends.registered Here Send the newsletter directly to your inbox every business day

[ad_2]

Source link