[ad_1]

This article is the live version of our Unhedged newsletter.registered Here Send the newsletter directly to your inbox every business day

Welcome back. One day I will stop writing about inflation, but today is not that day. Maybe inflation is just the name of all my economic anxiety right now? If you have other better fears to share, please send them to: [email protected].

In addition, I will take leave tomorrow. see you on Wednesday.

Crime of wages

I wrote about me last week exchange Together with the inflation-worried economist Olivier Blanchard (Olivier Blanchard), he gave some stern advice: “Focus on new wage contracts and wages like an eagle.”

Friday work report Provide some eagle food. The wages of unsupervised workers rose by 0.55% between April and May, and the annual growth rate was slightly less than 7%. That is high.

Since the sharp surge in the spring of 2020, wage growth has been very erratic, when so many low-wage workers were unemployed. But this is the second consecutive big month. As our reporter likes to say sarcastically, two are trends. Fed data:

Economic authorities were impressed. This is Rick Rieder, BlackRock’s fixed income chief information officer:

“The average hourly income data for the past few months… depicts a very tight labor market, and there is an urgent need to raise wages to allow people to enter the labor market.”

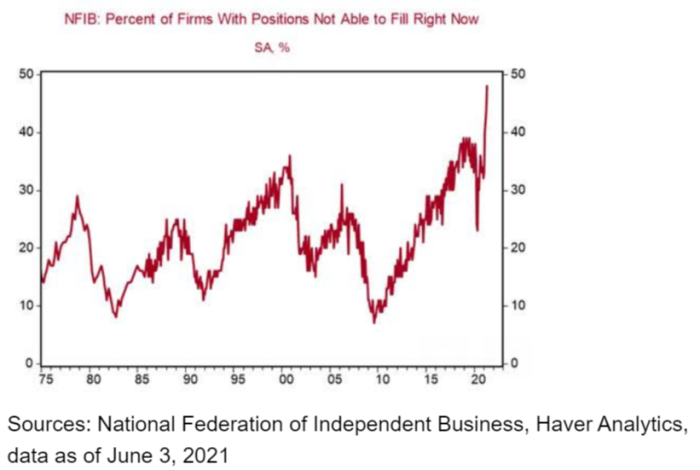

It sounds like the kind of thing that Blanchard warned about-workers with bargaining power “asked[ing] For and get[ing] Rising wages” created inflationary momentum. Rieder also provided this amazing survey data chart from the National Federation of Independent Businesses. Half of the companies said they need workers they can’t get:

Paul Ashworth, chief economist at Capital Macros North America, pointed out that the May wage data may actually underestimate wage pressures:

“The return of low-paid restaurant employees should affect this average, so the 0.5% monthly rate is higher than it looks, which shows that the growing labor shortage is being translated into rapid wage growth.”

Is it time to panic? I do like a good panic. But the market did not panic at all. Obviously, the focus is on the relatively cool growth of employment growth, not the explosive growth of wages (cool data = Fed keeps loose = asset prices rise). After the data came out and U.S. Treasury yields fell, stocks rose on Friday.

Although I like hyperventilation, I hate to declare that the market is completely wrong without a good reason.

One explanation for the optimistic market reaction is that, as some readers have emailed me to point out, the link between wage data and future inflation cannot be taken for granted. James Athey, the fixed-income portfolio manager of Aberdeen Standard, got in touch with him and believed that the competitiveness of the U.S. economy is so declining that many local markets are dominated by only a few employers or “labor monopolies”, and the leverage of workers in wage negotiations may Fleeting.

Athey also pointed out that the quality of wage data is not very good. It is basically a huge number (all income) divided into another (all workers). It conceals all aspects of the composition of labor, especially the fact that unskilled labor is increasing.

Other readers believe that the empirical data on wage growth related to future inflation is weaker than usually imagined. Dimitris Valatsas, Chief Economist at Greenmantle, pointed out to me This Reviewing the literature of the San Francisco Federal Reserve, the conclusion is:

“Researchers have extensively studied how wage data can help predict future price inflation. The overall conclusion of the literature is that wages are usually of lower insight into future prices than some other indicators. In fact, models that do not include wages usually do Lead to better inflation forecasts.”

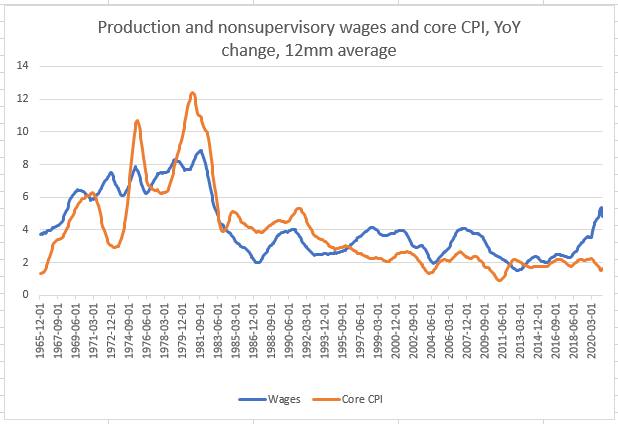

By the way, here is the long-term wage growth/core CPI growth chart. There is a clear connection between the two (the correlation coefficient is 0.76, Excel tells me), but if wages cause a clear pattern of inflation, it is difficult for me to see it:

I raised these objections to Blanchard. He acknowledged the controversy in the literature, but said that “I think the view that companies will not react to costs is completely unreliable, and the biggest cost is usually the payroll.” As for the composition of the labor force, he replied that in order to predict inflation, “What matters is wages relative to productivity. The composition of employment does not matter. If we hire more low-skilled workers, their wages will decrease, but their productivity will also decrease.”

There are many differences on inflation.

The final mystery of the epidemic: office real estate

This is a very interesting chart (from Refinitiv):

This is the performance of the three largest real estate investment trusts that have invested mainly in downtown office buildings since the beginning of the pandemic. I think the chart is interesting because, in my estimation, we know very little about what will happen to the demand for office space when the pandemic really ends.

Will demand be as strong as ever? With more employees working from home at least some of the time, do we need to reduce office space by 10%? Or will it be reduced by about 20%? Even less than this? I definitely don’t want to bet on this.

Based on evidence of office reinvestment, the market seems to be betting that the cash flow of office properties will be 10% or 20% lower than before the pandemic (but the loss estimates have been steadily decreasing). Maybe this is a good guess?

The reason we don’t know much about this is that no one wants to sell a building, or buy a building, or foreclosure, or quarrel over rent until the situation becomes more clear.

“No one is forced to suffer losses now,” said Jim Costello, senior vice president of real estate analyst firm RCA. “If I were a creditor and foreclosure, I would definitely suffer a loss, and if I made up a little bit, I would have a chance to make a profit.”

Last week, a senior real estate banker told me that the future of the office “is now the number one topic in our industry.”

“We don’t know what this means [of the pandemic] The need for space.On the one hand, if the space per square foot per person increases [for health reasons], This is positive. However, if you have fewer people in your office, use fewer desks. .. So far, we have not seen a major default, but job vacancies are on the rise. But cash flow remains strong. The biggest question is what happens when the lease expires, which takes time. “

How worrying is this for the industry? This is the most recent investor presentation slide of Boston Real Estate. You can smell the pouring of fear:

Our customers just love their office! They really did it! They keep telling us this way! Oh dear.

On the other hand, Jordan Roeschlaub, co-head of debt and structured finance at real estate consultancy Newmark, provides an excellent reason to be optimistic about the value of office buildings, which a reader of this newsletter will be familiar with. There is a lot of money to look for a house outside.

“A lot of funds have been raised for the real estate sector. When the transaction enters the market, this must have an impact. [Investors] This money must be put into work, and they must make up for lost time because no transactions were made during the pandemic. “

A good book

This The excellent business story, about American carpets, lost its way in the Sunday New York Times and somehow ended up in the style section. The history of the American textile industry is fascinating. I hope it can make a comeback in the post-epidemic era, and that the factory’s work may one day return to Eden, North Carolina.

[ad_2]

Source link