[ad_1]

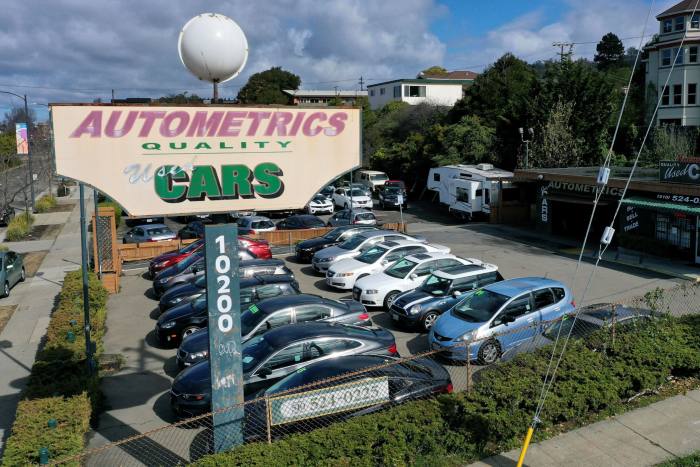

Last month, Carey Cherner, a 36-year-old used car dealer in Kensington, Maryland, sold a 2001 Ford F-150 pickup truck in less than 12 hours. The mileage is 184,000 miles. It sells for $7,500-50% higher than usual.

Cherner’s experience is not one-off in the US used car market, where prices are rising rapidly. The industry is at the core of the country’s growing inflationary pressures — and has therefore become a subject of great interest to policymakers in Washington.

“There are more people buying cars than there are cars on the market, which makes it a little crazy,” Cerner said.

Unusually, officials pay close attention to used car prices as an indicator of future inflation paths. If price increases become entrenched and spread to other parts of the economy, the United States may face prolonged overheating for the first time in decades. Presented a big challenge Economic decision makers at the Federal Reserve and Joe Biden.

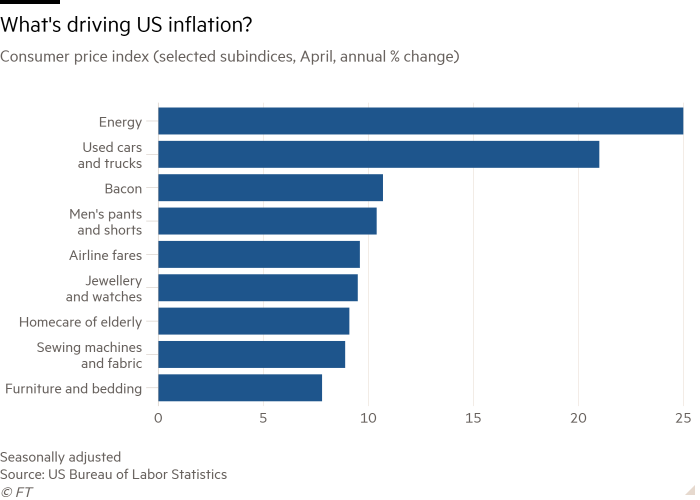

The cost of used cars and trucks rose 10% month-on-month in April and 21% year-on-year, making them one of the main drivers. 4.2% The Consumer Price Index of the US Bureau of Labor Statistics has soared year-on-year. The core inflation rate-excluding fluctuating food and energy prices-reached 3%.

Ernie Garcia, founder of the online used car sales platform Carvana, said: “There is no doubt that the price is higher than ever, and there is no doubt that it is changing faster than I think.”

Inflation: a new era?

Prices in many major economies are rising. The British “Financial Times” investigates whether inflation will recover forever.

Day 1: For decades, advanced economies have not faced rapidly rising inflation. Is this going to change?

Day 2: Central Bank Governors reach a global consensus on how to best promote low and stable inflation Has collapsed.

Day 3: Canaries in the coal mines of American inflation: used cars.

Day 4: How the virus destroys official inflation statistics.

Day 5: Why price increases in developed economies are a problem for debt-laden developing countries.

Policymakers insist that the pressure will gradually diminish, strengthening their view that the broader inflation trend will be mainly temporary. In a speech on Tuesday, Federal Reserve Governor Lael Brainard stated that although pressures on used car costs “may continue in the summer, I expect them to subside in subsequent quarters and may be reversed”.

However, although many economists agree that inflationary pressures may be temporary, they also acknowledge that the economic outlook is highly uncertain; as the pandemic subsides in the United States, consumer savings and government payments are abundant, while the supply chain Nervous due to bottlenecks.

“We have seen unprecedented levels of stimulus in the past 50 years, as well as other forms of spending support. These are indeed uncharted territory, and we must remain humble,” said Nathan Sheets, chief economist of PGIM Fixed Income and former deputy secretary of the US Treasury. “How confident am I that inflation will dissipate? It may be 80%, but it is still a fairly fat tail.”

Federal Reserve President Lael Brainard said that pressure on the used car market should abate later this year © Taylor Glascock/Bloomberg

Due to the blockade and semiconductor shortages, the slowdown in new car production has driven prices soaring.

In addition, during the recession, the number of customers who defaulted on car loans and recovered their cars declined, cutting off another source of supply for dealers such as Cherna.

At the same time, demand surged. Due to the pandemic, Americans’ preferences have shifted away from public transportation. Incentives help them spend money. Car rental companies that sold their fleets last year due to travel collapse are now scrambling to rebuild them with used cars.

“It’s very nervous now: you have more demand… This is supported by fiscal stimulus, so it’s like a perfect storm. We see this clearly in the price,” Senior Economist at MacroPolicy Perspectives Laura Rosner said.

But Jonathan Smoke of Cox Automotive, a car dealership consulting firm, pointed out that “several leading indicators that happened at our auctions” indicate that “the price increase momentum may end.”

The cost of used cars and trucks in the U.S. rose 10% month-on-month in April © Justin Sullivan/Getty

This allows economists and US officials to consider how long it will take for price growth to return closer to the Fed’s average target of 2%, which allows for some overshoots.

Goldman Sachs predicts that the core inflation rate will reach a year-on-year peak of 3.6% in June and will drop slightly to 3.5% by the end of the year, with an average of 2.7% in 2022.

Fed officials not only pay attention to headline inflation and core inflation, but also pay attention to other price growth indicators.

The core personal consumption expenditure index-traditionally the Fed’s preferred indicator-rose by 3.1% in April, although the Dallas Fed’s average PCE indicator rose by 1.8%, but by a small margin.

The US Central Bank has also developed a quarterly index of common inflation expectations to assess whether they are deviating from their targets; its next reading will expire in July. Despite these efforts, the uncertainty still disturbs some economists and investors.

Lynda Schweitzer, co-head of Loomis Sayles’ global fixed income team, said: “Overall, our basic assumptions about inflation have not changed, but our belief in this view must be lower.” “We must consider more permanent risks.”

In Maryland, Cherner is optimistic about the prospects.

“I didn’t see a sharp drop [in prices] Until there is an oversupply,” he said. “They still need to build new cars, put chips in them, and then take them out. I just think it will last. ”

[ad_2]

Source link