[ad_1]

This article is a live version of our trade secret newsletter.registered Here Send the newsletter directly to your inbox every Monday to Thursday

Hello from South Korea’s stunning Jeju Island, where Trade Secrets is busy sampling crustaceans excavated from the famous deep ocean Haenyeo.

Back on the mainland, President Moon Jae-in returned to China after meeting with President Biden at the White House.North Korea ranks first in name, but China is Elephant in the room. South Korea is one of the countries that Biden has promoted to join its efforts to deal with Beijing’s expanding influence. But as we are discussing today, South Korea, like many other countries, is unable to start eyeing Beijing. Especially in the manufacture of batteries, the most important component in electric vehicles, Seoul hopes to dominate the industry.

We hope to hear from you.Send any ideas to [email protected] Or email me [email protected]

The influence of Chinese bases on electric vehicle materials

Precipitate with mixed nickel and cobalt hydroxide. Lithium iron phosphate. cathode. anode. If you are not yet familiar with the jargon, don’t worry-we will all be familiar soon.

The world is running in an ambitious direction Climate change target. The key to many governments’ carbon reduction plans is to quickly switch from fuel-guzzling cars to electric vehicles, and from coal-fired power stations to renewable energy.

South Korea, some of the largest in the world Electric car battery manufacturer, At the core of global transformation.

The special units spun off from companies such as LG, SK and Samsung are Fast cooperation Cooperate with large automobile groups such as Ford, General Motors and Volkswagen. A new South Korean-owned battery manufacturing plant is sprouting from Ivanchisa, Hungary to the business district of Georgia in the United States.

However, when it comes to raw material When it comes to manufacturing these batteries, South Korea—in fact, the entire electric vehicle supply chain—relies heavily on China.

A simple look at the extraction location of the above-mentioned minerals conceals an inconvenient fact.

Indonesia is the world’s largest nickel producer.Democratic Republic of the Congo is more than two-thirds of the source cobalt.More than half of the world lithium From Australia, nearly one-third of the copper comes from Chile.

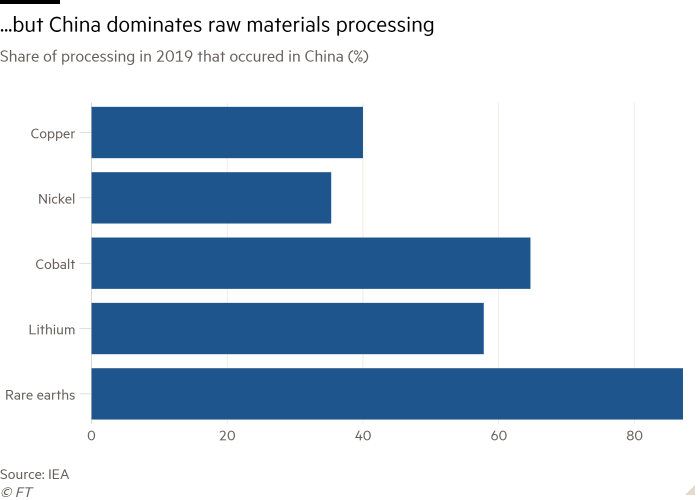

However, so far, China is the largest processor of these minerals. When it comes to rare earth metals-some of the raw materials used in electric car engines, as well as countless electronic devices essential to modern technology-the country’s dominance is even deeper.

The International Energy Agency pointed out that China’s share of rare earth element processing—the conversion of rare earths from mined materials into oxides, metals, and magnets for batteries—reached a staggering 90%.

As the consultants Ross Gregory and James Kruger of the Key Materials Department wrote last month Australian ($, subscription required), it is wrong to think that China’s hegemony stems from “evil conspiracy”. . . Take the world’s ransom”.

They said: “On the contrary, the West is willing to dump its ore and concentrate in China, allowing the Chinese to perform ugly processing technology with high carbon emissions.” “Unsurprisingly, China looks to the future and gains support for this industry through cheap land and reagents. , Recognize the long-term strategic rewards.”

Compounding the situation is the demand outlook for these key minerals: the IEA predicts that it will reach Goals of the Paris Agreement In the next two decades, the world needs to quadruple the production of minerals used in clean technologies.

Companies and governments are working hard to meet the challenges, albeit slowly.

Pohang SteelersSouth Korea’s national steelmaking champion is a symbol of those who try to take advantage of it. The Seoul-listed group broke ground in recent days on a site near the Gwangyang Iron and Steel Plant, west of the port city of Busan, which will extract lithium hydroxide from spodumene delivered by Australia’s Pilbara Mining Company.

But a joint venture like this will take several years to achieve.At the same time-over a period of time Huge demand growth — China’s dominance in the mineral processing sector looks solid. This has no shortage of impacts on Asia’s broader trade policies.

For South Korea, a country trying to monopolize the electric vehicle market through cars, batteries and new high-tech components, the impact on China is profound.

Seoul is also vigilant so as not to provoke another Strong opposition from Beijing Rear China boycott Four years ago, in response to South Korea’s deployment of the US missile defense system.

When this and South Korea’s electric car ambitions, coupled with the fact that it relies on China as its export destination for about a quarter, it is no wonder that Moon Jae-in has withstood the pressure of Biden’s request to join the US leadership’s criticism of Beijing.

Seoul’s response will frustrate some in Washington. But this caution may also indicate the extent to which Biden can promote even the closest ally of the United States.

More broadly, in a Widely reported The IEA found that the investment plan is “not yet ready to support an accelerated energy transition”.

This means that just as the world is seriously trying to transition to clean fuels, a bottleneck is coming.

“Many of today’s energy transition mineral production and processing operations are highly concentrated in a few countries, which makes the system vulnerable to political instability, geopolitical risks, and possible export restrictions,” the International Energy Agency said, noting that China’s The ban on mineral exports and Indonesia are examples of recent problems.

Trade ties

Xing Yuqing, professor of economics at the Tokyo National Policy Research Institute, wrote an article Fascinating works on No factory manufacturer Explain how the trade value of its output may be greatly underestimated. He pointed out that the added value of intangible assets embedded in tangible goods is not recorded in any country’s trade statistics.

New research shows The world is divided into three modes in order to Regulation of personal data, Influenced by the practices of China, the European Union and the United States, has an impact on digital service trade.

The FT editorial board insists on the European Union and believes Slow Motion Swexit, The consequences of the failure of the negotiations between Switzerland and the EU on closer economic relations, Not good for any party.

Newest OECD Economic Outlook Shows that the impact of the pandemic on trade in services far exceeds trade in goods, and some countries have benefited from greater trade Medicines, medical supplies and IT equipment.

At the same time Joint column In the “Washington Post”, the heads of the World Trade Organization, the World Health Organization, the International Monetary Fund and the World Bank stated, $50 billion for vaccination By 2025, it will bring about 9 trillion US dollars of additional global output.

More than 20 Japanese companies seize the opportunity to save the country from shrinking Semiconductor Industry after Funding government programs Establish a local factory with Taiwanese chip manufacturing group TSMC ($, subscription required). The government intends to establish a joint public-private sector to cooperate with TSMC, hoping to reap the rewards by improving the international competitiveness of Japanese industries.

[ad_2]

Source link