[ad_1]

During the Covid-19 pandemic, people are turning to homework, online consumption and social isolation, which have promoted increased investment in new technologies, which may give an unexpected boost to the long-term productivity downturn in the UK.

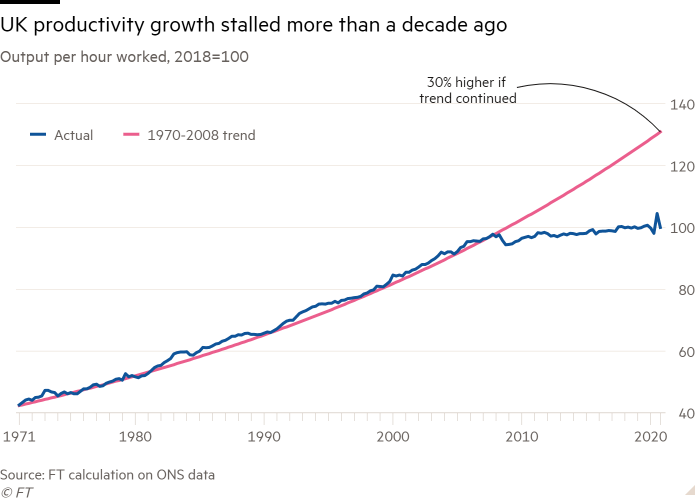

Since the 2008-09 financial crisis, the UK has been experiencing a productivity crisis, and this slowdown is more serious than any other Western country.

Economists say that low productivity growth is important because the output per hour of work or the added value of productivity enables companies to increase workers’ wages and ultimately improve living standards. Higher productivity also increases the government’s resources for improving public services or reducing taxes.

However, according to data from the Office for National Statistics in the first quarter of 2021, the UK’s investment in machinery and ICT compared to the last quarter of 2019 (the last three months before the pandemic hit the UK) , An increase of 3.2%. In contrast, overall investment fell by 4.8% over the same period, while output in the UK fell. 8.7%.

What encourages economic experts is that investment in new technologies and machinery is to a certain extent accompanied by a greater degree of business innovation and personnel retraining, thereby increasing the level of productivity.

By 2020, spending on intellectual property products such as software and patents will also surge Statistics display Labor productivity will increase in 2020 and the first quarter of this year.

Mark Posniak, managing director of Octane Capital, a professional loan company, said that last year’s first national lockdown was a “trigger” for its process automation. “We are now a more streamlined, digital-first lender, which really proves its value among our borrowers and partners.”

At the same time, Craig Bunting, the co-founder of the coffee chain Bear, said that before the pandemic, they focused on the high street market. “Covid-19 changed everything,” he said. “We have built a complete e-commerce platform in just a few months.”

Andy Haldane, Chief Economist, Bank of England Say Earlier this month, R&D and digital spending “actually matured and did grow very unusually during periods of weak activity.” “This may provide some clues to productivity and make our work better than we originally thought. It’s better”.

He added that the switch to homework during the pandemic has increased productivity.

According to a recent research report, due to increased productivity, nearly half of British companies plan to switch to larger homework as a permanent business model. ONS investigation.

Martin Spring, director of the Center for Productivity and Efficiency at the Lancaster University School of Management, said the coronavirus has inspired companies to introduce changes that might have been delayed.

“This is really important. Organizational changes, skills changes, and abilities must be changed. This is what makes it different… If there is no pressure… Sprint said: “You may escape without interruption. “

Jefferies economist David Owen said that the United Kingdom is a country with low productivity. This concept may be challenged by the pandemic, which forces the emergence of “new ways of doing business and innovation.” .

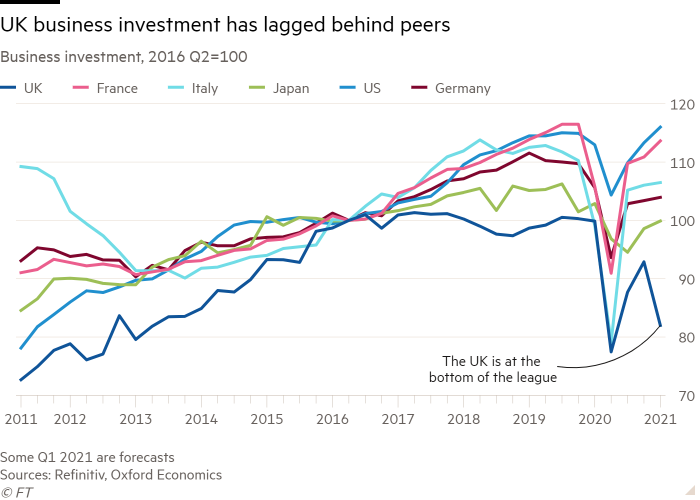

For a long time, the productivity crisis in the UK has been a concern of economists. Since the EU referendum in 2016, the high uncertainty of Brexit and low business investment have further limited the UK’s prospects.

Although digitalization is booming in 2020, business investment in the UK has fallen by 18% compared to the second quarter of 2016, while the US has achieved double-digit growth rates.

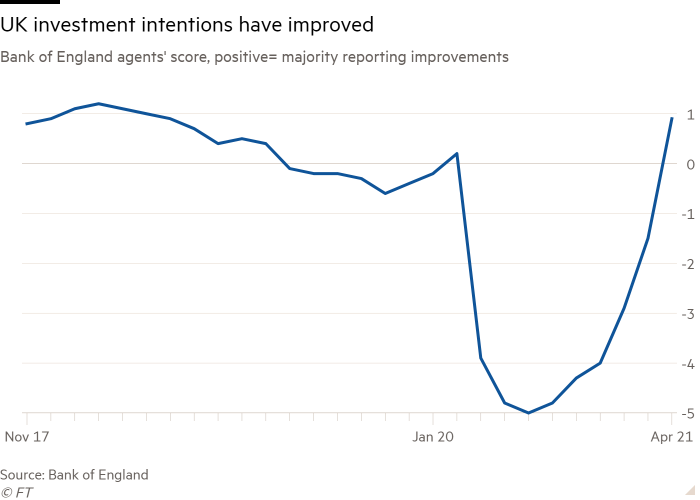

However, surveys conducted by the Bank of England’s agents showed that the company’s investment intentions (including the current very low spending on buildings and transportation equipment) rebounded in April, which largely reflects the relationship between Brexit and the Great Britain. The uncertainty associated with the epidemic has diminished. The economic outlook is bright.

According to Oxford Economics (Oxford Economics) data, driven by the government’s two-year tax relief policy, business investment in the UK is expected to grow faster than other G7 countries in the next two years, which allows companies to benefit from 130% of his investment is deducted from taxable income.

But Andrew Goodwin, an economist at the Oxford Economics Institute, warned that business investment will still be limited by the cost of repaying the debt that companies were forced to bear during the pandemic. He said: “Brexit may also become a key resistance.”

Goodwin added that “super deduction” is a “relatively narrow focus, which is temporary in nature” and “it is hard to believe that it will have a significant long-term positive impact.”

Ben Broadbent, a member of the Bank of England’s Monetary Policy Committee, also Warning He said that reducing the use of capital such as office and transportation infrastructure will drag down productivity in the short term.

Others pointed out that if this trend cannot be sustained, a one-time adjustment of innovation cannot have a lasting impact on productivity.

Spring said: “The trick now is to stick to these changes and build on them, even if the pandemic’s expedients are diminishing.”

Bart van Ark, managing director of the Research Institute Productivity Institute, said that although the changes in digital transformation put the UK in a better position to benefit from new technologies in the future, “digital transformation is not a one-time investment, but a journey.”

He added that the UK’s productivity is much lower than France and Germany, so that even assuming stronger productivity growth in the next few years, “this will require the UK to outperform the broader market in terms of investment and business practices for a considerable period of time. In order to significantly narrow this gap”.

[ad_2]

Source link