[ad_1]

This article is the live version of the unhedged newsletter.registered Here Make press releases sent directly to your inbox every business day

Welcome back. Two weeks after writing “Unhedged”, I was exhausted but very excited. Hope you enjoy this journey. Email me([email protected]) And spend a relaxing long weekend.

Suspense of inflation killed me

I mentioned last week Inflation concerns, Just wave it.The last great inflation in the U.S. report It looks like you hope it will reopen economically. Only the sectors that were crushed by the pandemic showed sharp inflation. Therefore, the Fed still seems unlikely to tighten policy in the short term, or even talk about tightening policy. So: everyone is cool!

It got a little bit cold this week. Last Thursday, we received a strong report on initial jobless claims (406,000 new applications, down from 444,000 last week, and a sporadic gap from the pre-pandemic level of 220,000). Fed Vice Chairman Randy Quarles said on Wednesday:

“If my expectations for economic growth, employment and inflation in the coming months are confirmed, … especially if they are strong… this is for [Federal Open Market Committee] At the upcoming meeting, we will begin to discuss our plan to adjust the speed of asset purchases. “

This is what we call talking about austerity.

Nevertheless, we should not switch to battle. Inflation data is still binary data, usually volatile, based on commodity prices or data related to reopening, while stable consumer data is still within the range deemed appropriate by the Federal Reserve.

This is a nice chart provided by Strategas, which shows a comparison of the inflation index measuring consumer price inflation and the price inflation that manufacturers pay for inputs:

One of the lines is scary and the other is not scary (since Don Rismiller of Strategas is more nervous than me, I should pay attention to what he said: “Inflation increases and investigations into inflation expectations are becoming hard to ignore.”

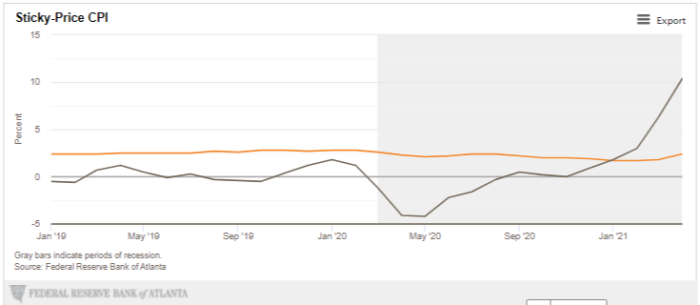

Under the same theme, this is a picture of the stickiness (such as insurance, alcohol, mobile phone bills) and flexible (gasoline, milk, hotel rooms) consumer price inflation measures of the Atlanta Fed. The orange line is the sticky line:

Similarly, volatile substances do not seem to have a strong gravitational effect on stable substances. If the situation changes, please pay attention, but it has not changed in my opinion.

Where does that leave us? Hanging. The following is a chart corresponding to the S&P 500 index and the five-year inflation expectations (ie, long-term inflation expectations) starting from the five-year period:

Although inflation expectations have been rising throughout the recovery process, the market still ran the risk of over-interpreting the chart until late April. Then, people began to worry about inflation. Since then, the market and inflation expectations have shifted sideways. The two tied. At some point, the tiebreaker will start the game.

Housing is provided again, now there are more data

A few days ago, I wrote an article about the recent House price rise It may indicate that the epidemic has exacerbated the benign imbalance between supply and demand, or it may indicate that speculative surplus is spreading to housing. If it’s the latter, it’s not good. We don’t want to have multiple interrelated speculative euphorias at the same time.

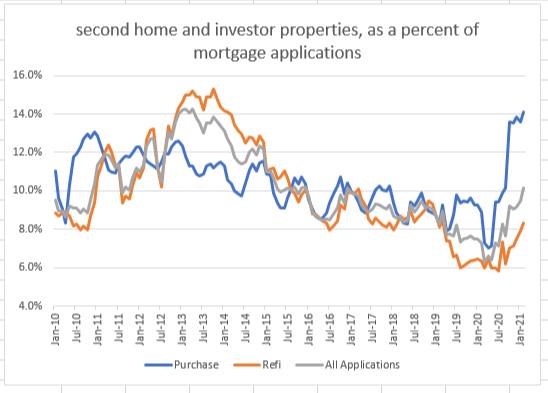

A standard surrogate indicator of speculation in the housing market is the number of houses purchased, not houses purchased for the owner, that is, houses purchased by flipping or renting. I didn’t have timely data a few days ago, but it turns out that the Mortgage Bankers Association tracked this. This is the data until the MBA, until February of this year:

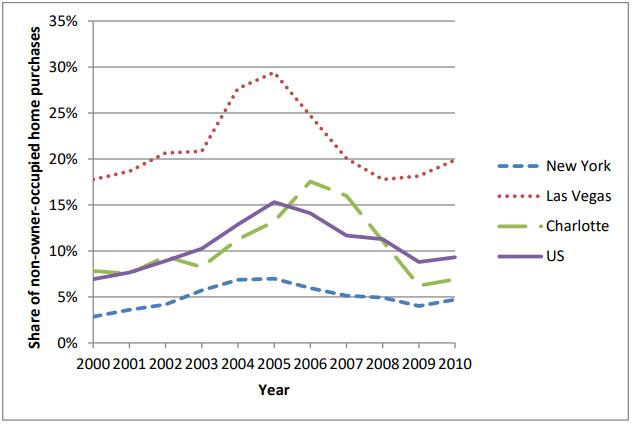

At the end of April last year, some changes did take place in the buying market. It might just be people buying holiday homes to leave the city! But 14% is a large part of the market. For comparison, here are some long-term data, set Princeton University economist Wei Xiong and his colleagues said:

At the peak of the real estate bubble, the proportion of all houses that were not the main house purchased reached 15%. If the two data sets are equal, the indicator is now at bubble level. But I am not sure if they are equal. MBA data is based on surveys; Xiong data comes from application disclosures collected by the government.

Does this mean that we are entering the second round of the real estate bubble? Do not. First of all, buyers’ leverage ratios are much lower today than they were in 2005. Moreover, like all economic data now, we may be paying attention to an epidemiological anomaly in the MBA data, and this phenomenon may be weakened. Mortgage applications and homes for sale have recently started to decline. It is hoped that housing prices and the purchasing power of non-residents will decrease accordingly.

Two good readings: smells good

In the “Financial Times” this weekend, I wrote perfume. If this article is as interesting to your reading as it is to my writing, please check out this excellent article. article Regarding the scent that came out in The New Yorker earlier this year. Once you start thinking about these things, it becomes addictive.

[ad_2]

Source link