[ad_1]

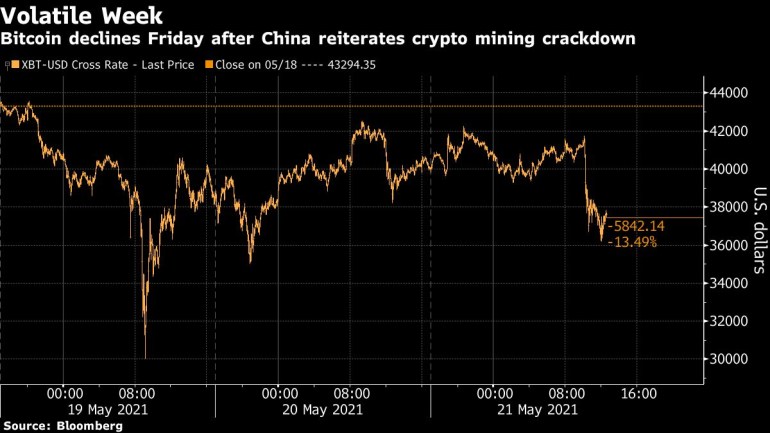

The largest digital currency fell by 10% in late Friday trading, as low as $35,636, and other tokens also posted double-digit losses.

Following a new warning from Chinese officials about cracking down on cryptocurrencies, Bitcoin once again entered a free fall over the weekend.

The largest digital currency fell as much as 10% late Friday, as low as $35,636, and its counterparty tokens also experienced double-digit losses. The coin almost touched $30,000 earlier this week, and it was $49,100 at the end of May 14.

When the State Council of China reiterated its call to reduce Bitcoin mining and trading, it was the latest blow. The cryptocurrency market has been turbulent earlier this week due to forced sales and possible U.S. tax consequences.

Former supporter Elon Musk made a face-to-face attack and criticized the energy consumption of the token. Friday’s sell-off hit Bitcoin believers. Since last Friday, Bitcoin has fallen by about 25%, although it has fallen to $30,000 from Wednesday’s decline. Other coins have also plummeted-in the past seven trading days, Ether has fallen by about 38%.

Musk began to suspend accepting Bitcoin payments at Tesla Inc. and used cryptocurrency boosters to conduct barb transactions on Twitter, which began to be outrageous. The Central Bank of China increased the funds on Tuesday and issued a warning banning the use of virtual currencies. On Thursday, the United States may require to report crypto transactions of $10,000 or more to tax authorities.

China has long expressed dissatisfaction with the anonymity provided by Bitcoin and other encrypted tokens, and earlier warned that financial institutions are not allowed to accept it for payment. The country has a large number of crypto miners from all over the world, and these miners require large amounts of electricity, and therefore run counter to the country’s efforts to curb greenhouse gas emissions.

Bobby Lee, the founder and CEO of the encrypted storage provider Ballet, said in an interview on Friday: “Regulators have issued new guidelines and they are taking it seriously. They want to strengthen law enforcement.” Someone is talking about hunting down miners. The question is, can they catch all the miners?”

China’s move this week underscores the country’s continued desire to control the notorious asset class. Market observers say this is something China would rather be supervised by the People’s Bank of China.

Matt Maley, chief market strategist at Miller Tabak + Co, said: “The problem is not a real mining industry problem. They say this is done to control market risk. Part of it, but it does show that unless the People’s Bank of China controls it, China will not become a big market for cryptocurrencies.”

At the same time, Bitcoin’s volatility may continue to increase. Friday’s sell-off once again pushed Bitcoin down to the average price of the past 200 days. For some chart experts and technical analysts, Bitcoin may fall further to around $30,000, where it found support earlier this week.

This week’s volatility led to massive liquidation by leveraged investors and undermined the claim that cryptocurrencies will become more stable as the industry matures. Musk’s actions show that only a few tweets can still disrupt the entire market. But more importantly, the regulatory threats to the crypto market have been updated in the past few days.

“Investors underestimated the regulatory risks of cryptocurrencies because the government defended their profitable monopoly on currencies,” said Jay Hatfield, CEO of New York Infrastructure Capital Advisors. He said that in the United States, transaction reporting requirements may be imposed, which may be the “tip of the iceberg” of the potential U.S. Treasury Department’s rules on virtual currencies.

In terms of Chinese regulations, this may be a wait-and-see game.

David Tawil, President of ProChain Capital, said: “You must always be cautious with China-never too bullish or bearish.” “We will have to look at what the regulation brings. It’s the same thing. , This is another matter.”

[ad_2]

Source link