[ad_1]

This article is the live version of the “Trade Secrets” press release.registered Here To send the newsletter directly to your inbox every Monday to Thursday

Hello, Washington, and former US Secretary of the Treasury Larry Summers (Larry Summers) warns again of inflation risks after the attack on Joe Biden’s fiscal stimulus plan Reprimand The Fed’s loose monetary policy.

In the trade news, we covered the apparent delay in steel and aluminum tariffs between Washington and Brussels. Of course progress can be made. However, if Biden wants to avoid conflict with the World Trade Organization and fight more with Europe, more needs to be done.

Charter waters Focus on the impact of trade on sustainability.

We hope to hear from you.Send any ideas to [email protected] Or email me [email protected]

Will the United States abandon all pig tariffs and metal tariffs?

Harley-Davidson (Harley-Davidson) is an American motorcycle manufacturer, known as the “pig”. Recently, the company launched a newspaper advertising campaign to oppose the possibility of an escalation in the trade war between the United States and Europe. The advertisement declared: “We will not be forced to get rid of free and fair trade, nor will we give up our freedom of riding” because it opposes the impending 56% bicycle tariff in Europe and tries to stimulate consumers’ interest in bicycles. Transatlantic trade policy (we salute them).

Harley can breathe a sigh of relief now.When its pigs were shipped to Europe, they still faced high taxes, but on Monday The EU stated that it will not implement its planned upgrade (expires on June 1). This provided Washington and Brussels with breathing space as they tried to find out where the Trump-era Article 232 tariffs on European steel and aluminum had gone. This triggered European impossibility on clothing, bourbon and motorcycles. Revenge for American goods.

good sign? of course. However, we will never be able to completely resolve what can be said to be the most thorny issue among several thorny trade issues between the United States and Europe.

As a reminder, Trump imposed a 25% tariff on steel and a 10% tariff on aluminum on a series of allies including Europe, Canada and Mexico in 2018 (although the later USTR Bob Lighthizer (Bob Lighthizer) and then Re-apply Tariffs on certain Canadian aluminum products).

Despite the mixed attitudes towards Biden in the United States, Biden has now removed them (politically tricky) (as Europe hoped). The strong US steel industry and weaker primary aluminum manufacturers also support them. The United Steelworkers Union (United Steelworkers) and AFL-CIO (with 12.5 million members), the largest trade union federation in the United States, provide support for them. On the other hand, many American companies (mostly those that buy steel or aluminum processed into products) hate tariffs and blame them for price increases.Whirlpool and Ford have both recently complained about rising steel costs, and more than 300 companies in the United States are manufacturing Recently written Biden asked for tariff reductions. The Aluminum Association, which represents the majority of American and foreign companies in the industry (including those that process imported metal into sheet, foil, and plate forms) also firmly opposes it.

In order to reach an agreement, it is necessary to ensure that the U.S. steel industry and other companies imposing 232 tariffs will ensure that the removal of tariffs will not cause large quantities of imported metals to depress prices. Although Brussels has imposed a large number of anti-dumping tariffs on its own Chinese metals, it will help to promise them that Europe will do more to help cope with China’s overcapacity. Former Trump trade official Clete Willems (Clete Willems) said that the two sides can also do more on the issue of transshipment, through transshipment to solve the well-known country-produced steel, which is processed by a third country. Evasion of tariffs. First, it is necessary to strengthen oversight mechanisms and strengthen multilateral communication among US allies. Quotas may also be a more relaxed option than full-fat tariffs. When import prices exceed historical standards (usually roughly calculated based on the average of the previous three years), tariffs will be triggered. Scott Paul, chairman of the American Manufacturing Alliance, said that any new arrangement should also include a clear implementation mechanism.

Biden can also assure the domestic metal industry that the huge multi-trillion-dollar infrastructure bill, coupled with the trade protectionist “Buy America Principles” that guides US government spending, will stimulate demand for US steel and aluminum. In other words, the price is already high, Same price Iron ore for steelmaking (although it has fallen since the past week).

However, many people are still bored with the long-standing global steel and aluminum overcapacity problem. Paul said: “Section 232 tariffs are very helpful to the US steel industry and its workers.” “One of the limitations is that it does not directly solve the problem of global overcapacity.”

But Washington has another driver-the disturbing prospect of facing embarrassing reprimands from the World Trade Organization. Several countries have questioned the legitimacy of tariffs, and the United States will hope to avoid Geneva rulings that impose unreasonable taxes due to national security reasons. This is not quite commensurate with the WTO skeptics in Washington, who may see it as an attack on US sovereignty.

If the Biden administration is completely serious about resolving WTO issues, it will need to find a shortcut to get out of the current predicament without disturbing or harming American industry, while at the same time ensuring that an agreement is reached with Europe. It is good news that Europe maintains the momentum of upgrading. But before announcing a trade war, we and the pigs will be waiting for more signs of a solution.

Chartered waters

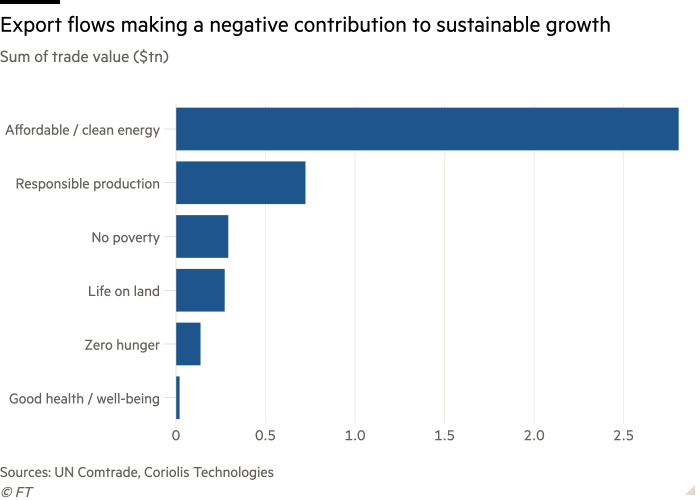

One of the emerging issues in trade (and almost all other areas of economic decision-making) is how to ensure that growth is sustainable. With this in mind, Coriolis Technologies, a producer of trade and trade finance data and analysis, proposed a data set that looks at how trade flows can contribute (or in other ways) to certain UN countries. 17 sustainable development goals.

The top chart is in billions, and the bottom chart is in trillions. The negative contribution of dirty energy to sustainability far exceeds any positive impact of green environmental protection. Coriolis uses trade flow data from the United Nations Commodity Trade Commission (UN Comtrade) as well as product codes and supply chain research to derive the index.

“The simple fact is that when you reduce trade to this basic situation, trade is not sustainable in its current form,” said Rebecca Harding, chief executive officer of Coriolis. )tell us. “We will always need to trade, and some of the products we need to trade will have a negative impact on the world-we just need to figure out how to turn simple and clear facts into simple and clear solutions. At least let us accurately first Measure the transactions we make and the transactions from there.” Claire Jones

Trade ties

Trade secrets Regular people will read many articles about the tensions between China and Europe, but rarely The relationship between London and Beijing After Brexit.This is today’s topic Big reading, The report explores the difficult balancing act needed to reconcile Britain’s new economic, political, and security needs.

This does not work well in DC. One of Taiwan’s few allies, Honduras owns caveat In order to obtain the Chinese coronavirus vaccine, it may be forced to transfer diplomatic loyalty from Taipei to Beijing.

Nikkei survey ($, subscription required) The seafarer’s plightSome of them have spent nearly a year because consumers are trapped at home, which has pushed up the demand for global shipping and caused freight charges to skyrocket.one left Great reading See why, despite Tensions between Canberra and Beijing, Australia’s iron ore miners are in a glorious period.

For those who cannot get enough Steel tariff Story, we recommend This piece From Wall Street Journal ($), which explains in depth why the policy has largely failed to produce the expected impact on employment and prices.

At last, The latest version of of Foreign affairs Those who focus on world trade ($) are worth those New insights on major geopolitical issues. Amy Williams and Claire Jones

Regarding any suggestions included in the article Trade link?send we Your tips.

[ad_2]

Source link