[ad_1]

How Henrik Follmann described the impact of Brexit on its household chemical companies as “a disaster”. The company is headquartered in northern Germany, and recently cancelled plans to expand its British factory due to Britain’s departure from the European Union.

Three years ago, Follmann Chemie planned to invest about 2.5 million pounds to produce more adhesives at its factory in Andover, southern England, to increase exports to EU customers. But its chief executive stated that the plan was undermined by the additional difficulties of transporting goods in both directions across the English Channel: “Brexit has always been a nightmare, increasing costs and time.”

“We intend to increase production and warehousing to provide products to customers on the African continent, but we have postponed production and have now made a strategic decision to cancel this plan and instead expand business in the European Union,” his family said. The third generation Foreman said. Operating companies.

Compared with many companies, Foreman’s Brexit is more severe. However, the increased cost and the experience of shipping delays between the United Kingdom and the European Union are typical examples of the distress of many companies in dealing with the additional bureaucracy and pitfalls brought about by the new customs inspection.

Henrik Follmann, CEO of Follmann Chemie

Even if the UK and the EU reach a final agreement Trade transaction In order to avoid imposing tariffs on most goods during Brexit on January 1, the trade between the two has always been It’s messy Higher transportation costs, transportation delays, health certification requirements and more complex customs requirements in border areas.

National Statistics Office Wednesday Say Britain’s exports to the EU in the first three months of this year fell by 18.1% from the previous quarter, while imports from the EU fell by 21.7%. In contrast, trade between the UK and non-EU countries increased slightly during the same period.

There are signs that the initial interference after Brexit has partially recovered, as trade between the UK and the EU increased in March, albeit at a slower rate than other countries.But since a comparable record began in 1997, the UK’s imports from outside the EU in March surpassed its imports from within the EU for the first time, highlighting the way the UK trades Transferred From the group.

“It may be too early to talk about the long-term impact of Brexit on trade. Although we have seen these major changes in the data recently, it may be that companies are starting to learn how to deal with these customs procedures,” Ludwig Munich- Lisandra Flach, professor of economics at Maximilian University, said.

Since the 2016 Brexit referendum, the United Kingdom has been a trading partner of other EU countries and has been steadily declining in this regard. According to Eurostat, China’s share of exports in the 27 member states has dropped from more than 17% before the vote to 14% last year.In January and February of this year, the UK’s share of EU exports outside the EU fall down Less than 13%.

Forman said that he is worried that some major British customers are considering transferring certain products to the European Union to serve the group’s customers. Since the Brexit referendum, there have been signs that foreign direct investment in the UK has been suppressed.

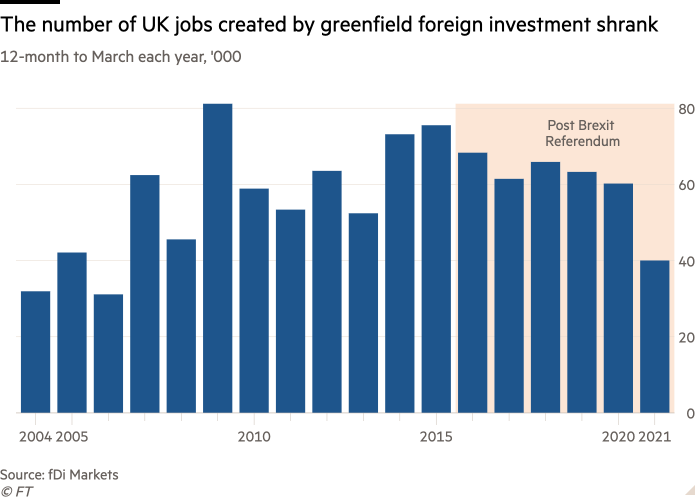

According to fDi data, in the five years ending March 2021, the number of FDI projects entering the UK increased by only 12% over the previous five years. This was due to the slow growth of investment in North America and Western Europe (main investment regions) Markets, a Companies owned by the Financial Times that track foreign investments. This is much lower than the 33% growth in EU countries.

In the 12 months to March 2021, the number of foreign greenfield investment projects entering the UK has fallen by 40% compared to the previous 12 months. Although this was largely the effect of the pandemic, the decline was greater than the 30% contraction of investment registered in the EU.

Flach said: “The company has made many adjustments in the years before Brexit,” he wrote for the German government a report on the impact of the British withdrawal last year.

Germany accounts for a quarter of all EU exports to the UK, which means that the impact of Brexit on the UK is greater than most countries. Many small and medium-sized companies that are the backbone of Germany’s export-oriented economy are struggling with the additional customs inspections and bureaucracy required to ship goods to the UK.

“There is no vaccine against Brexit,” said Klaus Winkler, chief executive officer of Heller. Heller is an expert in manufacturing crankshaft machines for milling engine parts. The factory is located in Nurdingen near Stuttgart in southwestern Germany. It has assembled many machines in Redditch at a factory in the UK.

Winkler said: “A truck from Nürtingen to Redditch takes twice as long. We have to spend more time in all the bureaucracies.” “This is troublesome. We have to increase the inventory. Level and maintain the inventory level because it has not improved.”

Paul Maeser of BDI, Germany’s main trade association, said many smaller companies have asked them to provide assistance with the new British customs requirements. He added: “Some of them say they can no longer cope with this, so they will no longer continue to serve this market.”

Both Heller and Follmann have encountered problems with the rules of origin clause in the Brexit trade agreement. These regulations stipulate that all products must be able to prove their “origin” in the European Union or the United Kingdom (the British content of most products accounts for about 50% of the British content) in order to be eligible for zero tariff treatment.

Certain products exported by Foreman to the UK are produced by third parties outside the EU, which means that they have begun to levy tariffs. The company’s chief executive said: “We did not expect this.” He added that the cost of container transportation in the UK has risen by 20% to 30%.

Winkler said that some Chinese customers require Heller’s products to be manufactured in the EU instead of the UK, which means that Heller has to re-produce to assemble more machines in Germany.

The UK has postponed comprehensive customs inspections of certain products imported from the EU until January, which means that even some of the largest exporters in continental Europe are worried that the damage of Brexit may worsen.

BMW has factories in the UK and the European Union. BMW said: “We welcome the fact that the Brexit Agreement has led to a zero-tariff trade arrangement, but the additional administrative complexity has increased our business costs, and this will make us take full responsibility. Until January 2022, the United Kingdom People can feel this feeling after the full implementation of customs control.”

[ad_2]

Source link