[ad_1]

The soaring prices of shipping commodities that promote global industrial development and sustain the world’s food supply have turned the fate of the troubled dry bulk shipping industry into a turn.

Roaring chinese Iron ore demandAs an important steel component, the manufacturing capacity of various parts of the world has resumed growth in recent years, and the insufficient investment in new ships has caused the price of bulk bulk carriers to rise sharply. The transportation of bulk bulk cargo is carried out in large cargo holds.

The Baltic Dry Bulk Freight Index, which tracks the prices of the three major categories of ships, has risen to the highest level in more than a decade, and has soared by 700% since April 2020. The Cape of Good Hope ship is the largest type, with an average deadweight of 180,000 dwt. Clarksons Platou Securities stated that the daily rent for a ton of steel is US$41,500 per day, which is nearly twice the amount a month ago. Eight times the average last year.

“China’s unsatisfied demand for iron ore has always been the single most important factor,” said Ulrik Uhrenfeldt Andersen, chief executive officer of Jinyang Group, the largest listed owner of the Capesize vessel. .

Iron ore is an important source of profits for some of the world’s largest miners. The price of iron ore hit a record high of nearly $230 per ton this week because Chinese steel mills have increased production to take advantage of high domestic prices.

Prior to this, as part of pollution control, the production of curbs was introduced in Tangshan, the highest steel-making city in China. However, the move is only to reduce production capacity and push up domestic prices, and steel mills in other parts of the country have seized this opportunity.

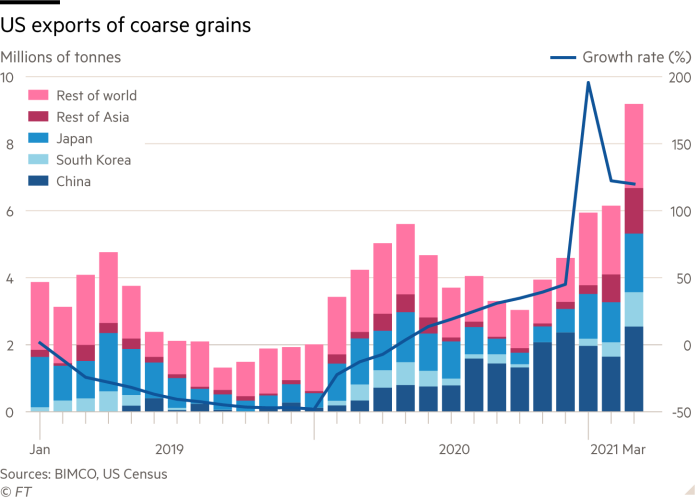

From the record high-level exports of coarse grains from the United States to the trade dispute between China and Australia, many other factors have also contributed to the tightening of the shipping market. The trade dispute between China and Australia bundled ships with coal and other materials, making them a port other than the port of the world’s largest commodity importer.

Norwegian aircraft carrier Torvald Klaveness (Torvald Klaveness) CEO Lasse Kristoffesen (Lasse Kristoffesen) said: “The stars are aimed at the dry bulk.”

Despite the strong growth in demand for raw materials, the field has been plagued by excess ship capacity since the financial crisis in September 2008. The decline in the commodity market caused by the pandemic last year has exacerbated the misery, but as the world recovers, the surge in demand for raw materials has helped change the fate of bulk carriers.

Christophson said: “For all large-scale commodity transportation, this has been a lost decade.” “This is a sluggish market, and the return is not enough, mainly because the fact that we ordered the ship is like there is no tomorrow. It has taken 10 years to remove it from the system.”

The industry is confident that prices will continue to rise this year. Petter Haugen, an analyst at Kepler Cheuvreux, said that cape-type vessels may earn $100,000 per day in the second half of the year.

Analysts pointed out that the fiscal policy to stimulate economic growth, the call to replenish depleted inventories, and the weak supply of new ships have all supported the rise in oil prices.

However, the industry is divided on whether the rally will be consolidated into a longer-term trend. The soaring commodity market prices have prompted people to talk about super cycles, that is, prolonged periods of high prices, because large economies are firing on all tanks. This has led to speculation about whether dry bulk transportation will produce a flow effect.

Joakim Hannisdahl, research director at Cleaves Securities, said that as shipowners postpone the possibility of buying a large number of new ships each month, the possibility of long-term price increases is increasing.

“as long as We have no new “black swans” On the demand side, then this may be a super cycle that people will never forget,” he said, referring to unexpected events with major impacts such as the flu pandemic.

Beginning last fall, before the rise in dry bulk carriers, the container shipping market has seen a rise, stimulating a wave of orders from shipyards, which has delayed the delivery date of any bulk carriers ordered now.

Edward Buttery, chief executive of the small aircraft carrier owner Taylor Maritime, said: “Non-bulk orders in the yard are rapidly increasing.” As institutional investors renewed interest in the shipping industry Since then, his company is preparing for a rare offshore listing in London.

Some shipowners want further tailwinds, pointing out that global regulations being debated may force ships to slow down steam to reduce carbon emissions in 2023, which will limit fleet availability.

“Another driving factor is that by 2023, new regulations on ship design and emissions are expected to be introduced. Approximately 75% of the dry fleet will not comply with the new regulations.”

But skeptics say that the main missing element of the super cycle is the lack of sustainable power like the rise of China, which drove the last round of high prices, and China’s imports now account for the dry bulk shipping market. Nearly half of it.

Environmental pressure is also declining. If China seriously considers reducing emissions and reducing steel production, analysts believe that restrictions in areas such as Tangshan will need to be introduced in other regions. The prospects seem even paler than coal used for power generation, which accounts for nearly 20% of seaborne dry bulk cargo transportation.

Peter Sand, chief shipping analyst at Bimco, a shipowner trade organization, said: “This decade will see a decline in thermal coal.” “When talking about climate change and dry bulk shipping, there are more obstacles.”

He added that as shipping capacity is still surplus, prices (still only about one-third of 2007 levels) may decrease.

“I do think this is a rare off-season event… There are some underlying factors that determine a certain degree of gravity.” He said. But he added: “What I don’t like about dry bulk transportation at the moment.”

[ad_2]

Source link